Age, income make a difference for Canadians' financial wellbeing

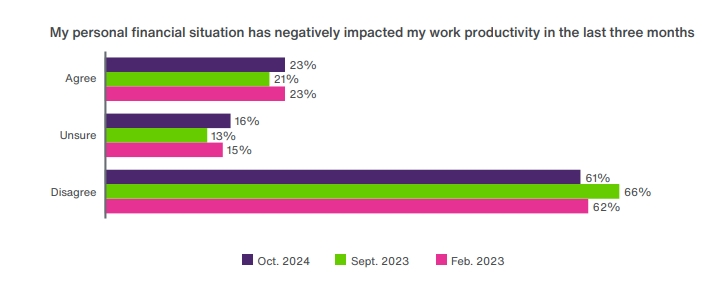

Financial stress is taking a significant toll on Canadian workers, with nearly a quarter reporting that their financial situation has impacted their productivity at work, according to a new report.

The findings paint a stark picture of the connection between financial wellbeing and mental health, with 28% of workers identifying finances as their primary source of stress—more than twice as prevalent as other stressors such as work, health, and personal relationships.

“Financial stress is impacting productivity, with nearly one-quarter of workers saying their financial situation has negatively affected their work productivity in the last quarter,” states the report from TELUS Health.

Younger workers hit harder

The data highlights that certain groups are disproportionately affected. Workers under 40 are three times more likely than those over 50 to say their financial situation has negatively impacted their work productivity. Parents are also struggling— they are 50% more likely than non-parents to report the same issue.

Adding to this, workers without emergency savings are particularly vulnerable, with TELUS Health finding they are five times more likely than those with savings to experience productivity loss due to financial stress.

Declining financial wellbeing

The report also notes a troubling decline in financial wellbeing. Only 47% of workers reported being in a good financial position in October 2024, down from 56% in September 2023.

Workers who say they are not in a good financial position have a mental health score more than 24 points lower than those reporting financial stability.

Financial anxiety is widespread, with 40% of workers admitting they always or often feel worried about their financial situation. This group’s mental health score is 33 points lower than those who rarely or never feel financial anxiety.

Younger workers are particularly at risk, with those under 40 60% more likely than workers over 50 to cite money as a major source of stress and anxiety. Parents are also significantly impacted, being 50% more likely than non-parents to feel financial strain.

Income plays a decisive role in financial wellbeing, says TELUS Health, with workers earning more than $100,000 annually 80% more likely than those earning less to report being in a good financial position.

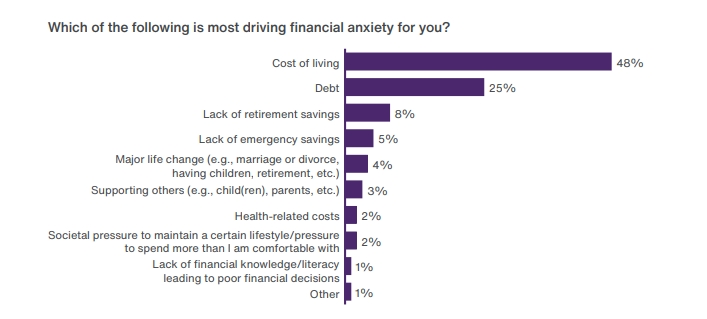

Cost of living, debt fueling anxiety

Rising living costs and debt remain key drivers of financial stress. Among workers experiencing anxiety about their financial future:

- 48% cite cost of living as the main cause of their worry.

- 25% blame debt as the leading source of stress.

- 8% highlight a lack of retirement savings as a key concern.

Sixty per cent of workers say cost of living pressures have affected their financial wellbeing, the report notes, adding that the mental health score of this group is nearly 24 points lower than workers able to maintain financial stability.

Debt also looms large for many Canadians. While 53% of workers are focused on reducing their debt, 14% admit they carry large amounts of debt and feel unable to manage it. Workers with significant debt have mental health scores 26 points lower than those without debt.

The findings of the TELUS Mental Health Index are based on an online survey conducted in October 2024 with 3,000 Canadian workers, selected to represent a diverse cross-section of age, gender, industry, and geography.