There's a wide range of eligible medical expenses that you can claim on your tax return. Find out which items and services qualify in this guide

Updated June 13, 2024

Figuring out what qualifies – and what doesn’t – as “eligible medical expenses” can sometimes be more of an art than a science. While the Canada Revenue Agency (CRA) provides a comprehensive list of what you can claim, the agency still notes that its list isn’t “exhaustive.” So, chances are, even if an item or service isn’t included, employees may be able to claim them on their tax return.

In this article, Canadian HR Reporter goes over what the CRA considers as eligible medical expenses. We will explore the different categories and check out which items qualify. We will also look into the documents needed when making a claim.

As more organizations move towards flexible benefits for employees, it’s important to get a handle on what items qualify as legitimate expenses. This guide can prove useful for employers, payroll and HR professionals, and employees wanting to get a picture of what medical expenses in Canada are eligible for tax deduction.

What are eligible medical expenses in Canada?

Eligible medical expenses are healthcare costs that qualify for a medical expense tax credit under the federal Income Tax Act (ITA). If you paid for these costs out of pocket, you may be able to claim them on your tax return as eligible medical expenses.

You can only claim for medical expenses that you will not be reimbursed. Healthcare costs that you’ve paid while traveling out of the country may likewise be eligible. Medical costs already covered by your provincial or private health insurance, however, don’t qualify for a tax deduction.

List of eligible medical expenses you can claim on your tax return

The CRA grouped the items and services you can claim as eligible medical expenses in several categories. Each has its own requirements. You can claim these healthcare costs on line 33099 on your tax return or use them to calculate an amount on line 33199.

On its website, the agency reiterates that “this list is not complete.” So, there may be expenses not included here that you may be able to claim.

1. Attendant care and care in a facility

The CRA defines attendant care as “care given by an attendant who does personal tasks which a person cannot do for themselves.” This type of care can be accessed through:

- nursing homes, for those needing full-time care

- schools and institutions that provide care and training

- outpatient clinics

All care costs incurred in these venues qualify as medical expenses, including those for:

- accommodation

- administration fees

- fees for social programming and activities

- food

- maintenance fees

- nursing care services

Salaries and wages for care personnel may be considered as eligible medical expenses, but you must either:

- be eligible for the disability tax credit

- have a written certification from a medical practitioner stating that these services are necessary

Extra personal expenses, such as those for salon services, don’t qualify, unless these are included in your monthly fees. Services from recreational facilities aren’t considered eligible costs, even if they cater to persons with disabilities. You also can’t make a claim for the salaries of other care service employees, including administrators, receptionists, and maintenance staff.

2. Care, treatment, and training

The CRA considers the following care treatment and services as eligible medical expenses that you can claim on your tax return.

- bone marrow transplant, including the cost to find a compatible donor, legal fees, insurance premiums, and travel expenses

- cancer treatment both in Canada and overseas

- cosmetic surgery not solely for cosmetic purposes

- egg and sperm freezing and storage

- fertility-related procedures

- laser eye surgery

- organ transplant, including the cost to find a compatible donor, legal fees, insurance premiums, and travel expenses

- personalized therapy plan, including the salaries and wages of specialists who designed the program; certain eligibility criteria apply

- pre- and post-natal treatments

- rehabilitative therapy, including lip reading and sign language training to help a person adjust to loss of speech or hearing

- school for persons with mental or physical impairments

- training costs if someone must learn to care for a relative with mental or physical impairments

- treatment centre expenses for those with drugs, alcohol, or gambling addiction; certification from a medical practitioner stating that a person needs access to the centre is required

- whirlpool bath treatments, costs paid to medical professionals

The cost to install a hot tub in your home, however, isn’t eligible, even if this is prescribed by a medical practitioner.

3. Construction and renovation

Renovation costs are considered eligible medical expenses if these are done to improve the mobility or functioning of a person with impairment in their home. The renovations must not be intended to increase the home’s value. Some examples are:

- installing outdoor or indoor ramps for those who can’t use stairs

- enlarging halls and doorways to give an impaired person access to the different rooms in the house

- lowering kitchen or bathroom cabinets, so an impaired person can reach them

The amount you can claim on your tax return excludes goods and services tax/harmonized sales tax (GST/HST), and other related rebates.

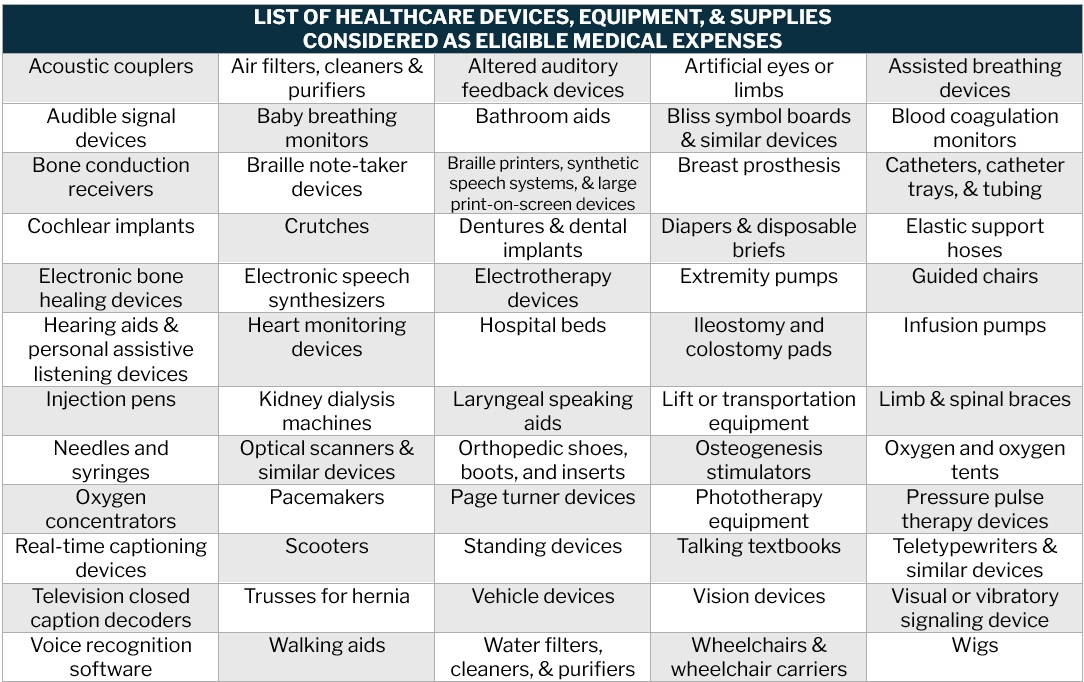

4. Devices, equipment, and supplies

You can claim the cost of the following healthcare supplies, devices, and equipment as eligible medical expenses in your tax return. A prescription is often required.

For air conditioners, the maximum amount you can claim is $1,000 or 50% of the purchase price, whichever is lower.

For vans used to transport a person in a wheelchair, you can claim 20% of the purchase price if the vehicle was previously adapted or adapted within six months after it was bought. The maximum limit is $5,000, but Ontario residents can claim up to $8,204.

Find out how data-driven, individualized benefits serve employees best in this article.

5. Gluten-free food products

Those with celiac disease can claim the incremental costs of buying gluten-free products as eligible medical expenses. The CRA refers to incremental costs as “the cost of gluten-free product minus the cost of similar products with gluten.”

To claim, you need the following documents:

- certification from a medical practitioner stating that the person has celiac disease and requires a gluten-free diet

- receipts for each gluten-free food product being claimed

- a summary of each food product bought during the 12-month period for which the expenses are being claimed

Other food products may also be eligible if these are used to make gluten-free food. These include rice flour and gluten-free spices. If food is consumed by several people, only the portion eaten by the person with celiac disease qualifies as a medical expense.

6. Prescribed drugs, medications, and other substances

You can claim the following as eligible medical expenses if these are prescribed by a medical practitioner:

- drugs and medical devices bought under Health Canada’s Special Access Program

- insulin and alternatives

- liver extract injections for persons with pernicious anemia

- medical cannabis, including plant, oil, and seeds

- prescription drugs and medications

- vaccines

- vitamin B12 therapy for persons with pernicious anemia

For medical cannabis, you must be registered as a client of a licensed provider. Under the Cannabis Regulations, you can only purchase cannabis products from the provider you’re registered with.

7. Service animals

The cost of care and maintenance of a specially trained animal can be claimed as eligible medical expenses on your tax return if you’re:

- blind

- profoundly deaf

- suffering from severe physical impairment that restricts the use of your arms and legs

- severely affected by autism or epilepsy

- suffering from severe diabetes (expenses must be incurred after 2013)

- mentally impaired (expenses must be incurred after 2017)

The cost of care for animals that only provide emotional support doesn’t qualify as a medical expense. The CRA doesn’t consider them specially trained to assist people in coping with their impairments.

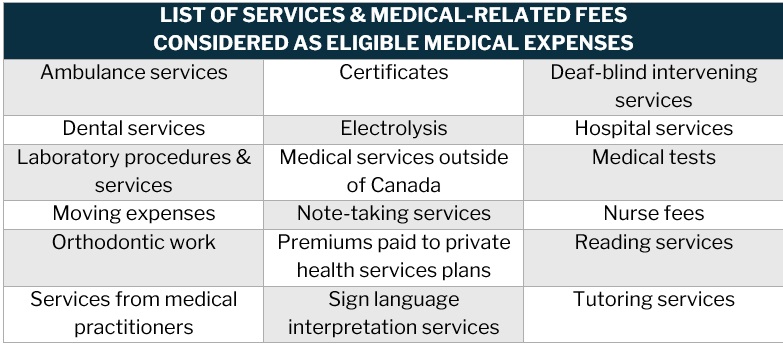

8. Services and fees

The table below lists the services and medical-related fees that you can claim on your tax return.

Procedures for purely cosmetic purposes don’t qualify as eligible medical expenses.

9. Travel expenses

You can claim transportation and travel expenses on your tax return if the following criteria are met:

- “substantially equivalent” medical care and services weren’t available near your home

- you took a reasonably direct travelling route to access those medical care and services

- it’s reasonable, under the circumstances, for you to have travelled to that place to access those medical services

If you can obtain certification from a medical practitioner that you can’t travel alone to get medical attention, you can also claim the travel and transportation costs of a companion.

List of medical expenses you cannot claim on your tax return

There are certain healthcare costs that aren’t considered eligible medical expenses. Here’s a list of what the CRA says “are commonly claimed as medical expenses in error”:

- athletic or fitness club fees

- blood pressure monitors

- diaper services

- health plan premiums paid by an employer and not included in your income

- liquid meal replacement products

- mobile applications that help you manage your blood glucose level

- nebulizers

- non-prescription birth control devices

- organic food

- over-the-counter medications, vitamins, and supplements – except vitamin B12 – even if prescribed by a medical practitioner

- purely cosmetic procedures

- personal response systems, including Lifeline and Health Line Services

- provincial and territorial plans, including the Alberta Health Care Insurance Plan and the Ontario Health Insurance Plan

- radon testing or radon mitigation treatment systems

- reimbursable medical and travel expenses

How can you claim eligible medical expenses on your tax return?

You can use line 33099 or line 33199 on your tax return to claim eligible medical expenses.

Line 33099 – Medical expenses for self, spouse or common-law partner, and your dependant children under 18

You can claim medical expenses that you or your spouse, common-law partner, and children under 18 years of age during the tax year using line 33099.

Line 33199 – Allowable amount of medical expenses for other dependants

You can use line 33199 to claim eligible medical expenses that you or your spouse or common law partner has paid for other dependants during the tax year, including:

- children aged 18 and above

- grandchildren

- parents

- grandparents

- brothers

- sisters

- uncles

- aunts

- nephews

- nieces

These dependants must be residents of Canada at any time during the tax year.

Here’s a step-by-step guide if you’re claiming for the 2023 tax year:

- Step 1: Enter the total amount that you, your spouse, or your common-law partner has paid for eligible medical expenses in the tax year

- Step 2: On the line below line 33099, enter the lesser of 3% of your net income (line 23600) or $2,635. Do the same for line 33199

- Step 3: Subtract the amount of step 2 from the amount on lines 33099, then enter the difference on the following lines of your tax return (Step 5 – Federal tax). Do the same for line 33199

- Step 4: Claim your provincial and territorial tax credits for individuals on line 58689 for line 33099 and line 58729 for line 33199 of your Form 428. For Québec residents, visit Revenu Québec

Tax experts say that it may be better for the spouse or common-law partner with the lower net income (line 23600) to claim the eligible medical expenses.

You may also need the following documents when making a claim:

- receipts, which must show the name of the company or individual to whom the medical expenses were paid

- prescriptions

- any certification provided by a medical practitioner

- Form T2201 or the disability tax credit certificate

These documents MUST NOT be sent with your tax return. You should keep them instead in case the CRA asks for proof later.

You can find more news and information about payroll and taxes in our Payroll News Section. Be sure to bookmark this page to access breaking news and the latest industry updates.

Did you find our guide to eligible medical expenses helpful? Which items there were you surprised to see or not to see? Let us know in the comments.