Calculating vacation pay on vacation pay is one of payroll's little quirks. Find out how you can remain compliant with your jurisdiction's rules in this guide

Updated August 12, 2024

At first glance, vacation pay is pretty straightforward. Employees work, they get paid wages for that work and on those wages, vacation pay must be paid.

But like many other aspects of payroll, it's not always that simple. One of payroll's little quirks is that vacation pay is often a vacationable earning on which vacation pay must itself be paid.

To shed light on this matter, Canadian HR Reporter delves deeper on what the applicable employment standards are regarding vacation pay on vacation pay. We will provide a breakdown of the different requirements in each province and territory. An industry expert will also highlight the key similarities and differences between vacation pay rules in each jurisdiction.

If you’re a payroll or HR professional wanting to gain a deeper understanding of how vacation pay works, this guide can help. Read on and learn the math behind vacation pay on vacation pay in Canada.

How does vacation pay work?

Vacation pay is a “percentage of the wages of an employee during the year of employment in respect of which the employee is entitled to the vacation.” This is the definition set by the Employment and Social Development Canada (ESDC). In simple terms, vacation pay is the portion of wages that a worker earns while taking time off from work.

Most employees begin earning vacation pay on the day they get hired. After their first year, they can start taking paid vacations. Each jurisdiction has its own set of rules regarding vacation pay and entitlements. How much compensation a worker receives while on vacation depends on these rules and the employer’s policies.

In most provinces and territories, two weeks of vacation time accrue a 4% vacation pay. Three weeks of vacation get 6%, four weeks receive at 8%, and so on.

Here’s a breakdown of the vacation pay requirements in each province and territory. You can also click on the links to learn more about the rules regarding vacation pay in your jurisdiction.

Provincial and territorial vacation pay on vacation pay requirements in Canada

|

Province/Territory |

Vacation pay requirements |

|

Employees with less than a year of employment are not entitled to vacation pay unless stated in the contract. For those who are, vacation pay is calculated as 4% of wages.

Employees with one to four years of employment are entitled to vacation pay at 4% of yearly wages.

Employees with more than five years of employment are entitled to vacation pay at 6% of yearly wages. |

|

|

Vacation pay is at least 4% of all wages paid in the previous year.

After a worker completes five years of employment, vacation pay becomes at least 6% of all wages earned in the previous year. |

|

|

Employees receive at least two weeks of vacation per year for the first four years of employment and a minimum of three weeks of vacation after the fifth consecutive year.

For each week of vacation, employees are entitled to 2% of the wages earned in that year. |

|

|

Employees with less than eight years of employment receive vacation pay at 4% of gross wages.

Employees with more than eight years of employment receive vacation pay at 8% of gross wages. |

|

|

Vacation pay is 4% of gross wages for employees with less than 15 continuous years of employment with the same employer.

Vacation pay increases to 6% of gross earnings for employees with at least 15 years of continuous employment with the same employer. |

|

|

Vacation pay is 4% of the total gross wages for the first five years of employment.

After the fifth year of employment, vacation pay increases to 6% of the total gross wages. |

|

|

Vacation pay is at least 4% of gross wages after the first 12 months of employment.

Vacation pay increases to 6% of gross wages at the start of an employee's eighth year of service. |

|

|

Vacation pay is calculated as 4% of the total gross wages of an employee from the start date of work and for the first five years of employment.

Vacation pay increases to 6% of the total gross wages for the sixth and subsequent years of work with the same employer. |

|

|

Vacation pay is 4% of all the wages earned in the vacation entitlement year for those employed for less than five years.

Vacation pay increases to 6% of all the wages earned in the vacation entitlement year for those employed for five years or more. |

|

|

Vacation pay is at least 4% for workers employed with the same employer for less than eight years.

Vacation pay is at least 6% for workers employed with the same employer for more than eight years. |

|

|

Employees with less than a year to not more than three years of employment are entitled to vacation pay at 4% of gross wages.

Employees with more than three years of employment are entitled to vacation pay at 6% of gross wages. |

|

|

Vacation pay is calculated by multiplying the employee's wages for the 12-month period by 3/52 (5.77%) for the first nine years of employment.

Once an employee has completed 10 years of employment with the same employer, vacation pay increases to 4/52 (7.69%) of their wages for the 12-month period. |

|

|

Vacation pay is calculated as at least 4% of an employee's gross wages. |

Under the Canada Labour Code (section 184), an employee is entitled to vacation pay equal to:

- 4% of their wages after a year of employment

- 6% of their wages after five consecutive years of employment

- 8% of their wages after 10 consecutive years of employment

The labour code also treats interns as employees but excludes student interns.

Find out the difference between vacation time and vacation pay according to an employment law expert in this article.

Vacation pay on vacation pay: Provincial and territorial comparison

In this section, payroll consultant and industry veteran Alan McEwan provides an overview of the similarities and disparities of vacation pay in the different jurisdictions. He is also a former contributor to CHRR. Here’s his analysis:

Vacation pay is a vacationable earning in British Columbia, Alberta, Saskatchewan, Newfoundland and Labrador, the Yukon, the Northwest Territories and Nunavut. It is also treated as such under the Canada Labour Code. How this works is simple:

- First, vacation pay is calculated based on employee wages.

- Second, vacation pay is itself a “wage” included in this definition.

Vacation pay is based on employee vacationable earnings, as paid in vacation years. Vacation years are 12-month periods, either based on the anniversary of employee hire or are common to all employees. Vacation pay is paid as a percentage of these vacationable earnings. The only exception is Saskatchewan, where instead of a percentage, a fraction is used — either 3/52 or 4/52.

The following example illustrates how this works:

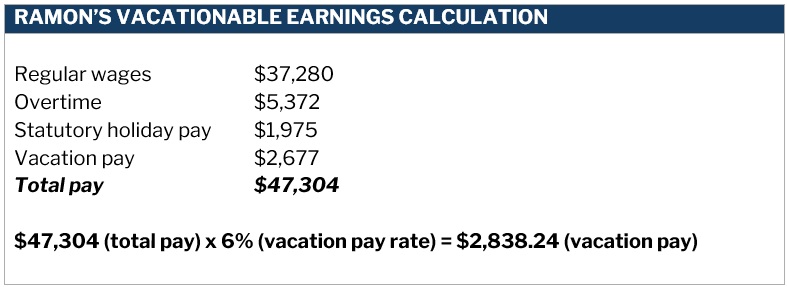

Ramon's vacation pay is subject to British Columbia’s employment standards. He is paid vacation pay based on the anniversary of his hire date, March 12. In the 12 months between March 12, 2011, and March 11, 2012, inclusive, he was paid the following wages:

- regular wages: $37,280

- overtime: $5,372

- statutory holiday pay: $1,975

- vacation pay: $2,677

Ramon's vacationable earnings in the year ending March 11, 2012, total $47,304. He is owed vacation pay at 6%. For these vacationable earnings, Ramon must be paid $2,838.24, as vacation pay. When paid, this amount must be included in his vacationable earnings for the vacation year ending March 11, 2013.

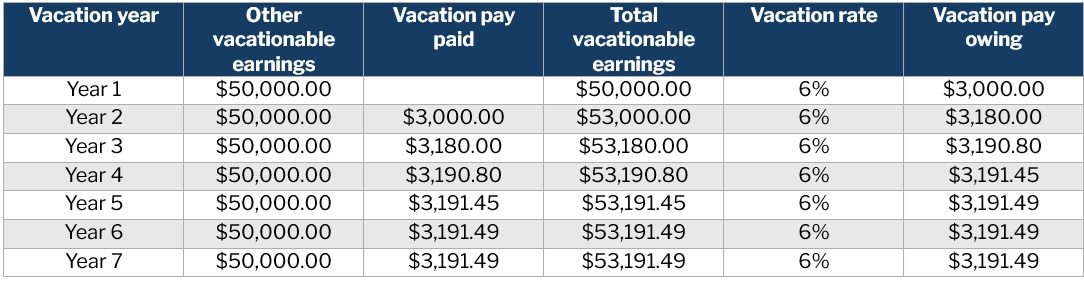

Here’s how it works out over a seven-year period. In the table, we hold Ramon’s vacationable earnings at a constant $50,000 and vacation pay at a constant 6%.

The numbers in the chart seem counterintuitive. You would think that vacation pay on vacation pay would compound each year, meaning each year there would be a larger and larger increase. However, that's not what happens.

As you can see, initially the increase in vacation pay is noticeable, then stabilizes. The reason for this stabilization is that over time the additional 6% – owing on the increase in the prior year's vacation pay – falls to less than a penny. When it does, there is no longer an annual increase in the amount of vacation pay owing.

Exceptions in vacation pay rules

McEwen, however, highlights several exceptions.

Alberta vacation pay

In Alberta, vacation pay is only a vacationable earning where the payroll frequency is not monthly. For employees paid monthly, a week's vacation pay is the total wages paid for normal work hours in a month, divided by 4 and 1/3. Note, it's the payroll frequency that matters, not how gross pay is defined or calculated.

Also, vacation pay may not always be a vacationable earning on termination. To be included in vacationable earnings, vacation pay has to be paid within a completed vacation year.

For example, assume the vacation year for an Alberta employee ends May 31. If vacation pay is paid to this employee on June 30, and then the person is terminated August 1, the vacationable earnings from the start of the current vacation year to termination do not include the vacation pay paid on June 30.

Newfoundland and Labrador vacation pay

In Newfoundland and Labrador, employees only qualify for vacation time if they have worked at least 90% of the normal work hours in the applicable vacation year.

For example, this threshold would be 1,757 hours for an employee who normally works eight hours a day, five days a week. This assumes a 52-week year, the employee takes both the six statutory holidays available and a two-week annual vacation.

The formula is: (8 x 5 x 52) - (6 x 8) - (10 x 8) x 90%

Employees who don't meet this test are only entitled to vacation pay on wages for hours worked in the vacation year. This effectively excludes vacation pay from vacationable earnings, since this is not direct wages for hours worked.

Vacation pay paid per pay period

Where employees are paid vacation pay with every pay, it's obviously not possible to treat the vacation pay calculated in each pay period as an input to that calculation itself. This would trigger a looping from which there could be no escape.

For example, if an employee's other vacationable earnings are $1,000, and the vacation rate is 4%, the vacation pay owing is $40.

Using simple mathematics, it would be impossible to then include this $40 as a vacationable earning in the same period, since the period's vacationable earnings would become $1,040. This would mean vacation pay owing of $41.60, triggering vacationable earnings of $1,041.60, in the next loop and so on.

How is vacation pay on vacation pay calculated?

Vacation pay is calculated as a percentage of the gross wages an employee earns during their “year of employment.” In most jurisdictions, the rule is:

- for vacation time of two weeks, vacation pay is 4% of earnings

- for vacation time of three weeks, vacation pay is 6% of earnings

- for vacation time of four weeks, vacation pay is 4% of earnings

ESDC defines a year of employment as continuous employment with the same employer for:

- 12 consecutive months starting with the hiring date

- 12 consecutive months starting on any anniversary of the date common to all employees

- a calendar year or another period of 12 consecutive months that an employer determines in accordance with the Canada Labour Standards Regulations

In most jurisdictions, an employee must complete a year of employment before they become entitled to vacation pay.

Here’s a list of what are considered wages and are, therefore, included in the calculation of vacation pay:

- regular earnings for work done

- overtime pay

- pay for time worked on general holidays

- pay for general holidays

- pay in lieu of general holidays

- vacation pay

- pay for personal leave

- bereavement leave pay

- pay for leave for victims of family violence

- pay for medical leave with pay

- pay pending an employer's decision on maternity-related reassignment or leave

- pay received during an administrative suspension

- any other remuneration – both monetary and non-monetary – an employee is entitled to under their contract of employment that meets the test of being for work performed, including:

- sales commissions

- flight pay

- northern allowances (isolation allowances)

- production bonuses

- safety bonuses

Here’s a list of what’s not included in calculating vacation pay:

- reimbursement of work-related expenses

- any amount owed to an employee upon termination

- tips and gratuities

- pay in lieu of notice of termination

- severance pay

- compensation for lay-over

- compensation under Division XIV (unjust dismissal)

- compensation for:

- a period of injury, disease, or illness for members of the Reserve Force that happens while on an operation in Canada or abroad

- an activity set out in the regulations

- Canadian Armed Forces military skills training

- training or duties for which they have been called out on service to perform under subsection 33(2) of the National Defense Act

- service in aid of a civil power for which they are called out

- treatment, recovery, or rehabilitation due to a physical or mental health problem resulting from service in an operation or activity referred to paragraph 247.5(1)(a) to (g) of the Code

Find out from an employment law expert if employers need to include vacation pay in severance package in this article.

When should vacation pay be paid out?

The Canada Labour Code requires vacation pay to be paid out within 14 days before a vacation starts. Employers, however, can pay it on the employee’s regular payday during or immediately after the vacation. This is if paying vacation pay within the set deadline is not practical or if it is the established practice in the workplace.

Just like vacation pay requirements, each jurisdiction sets different deadlines on when vacation pay must be paid.

Here’s a summary for each jurisdiction and territory.

|

Province/Territory |

Vacation pay deadline |

|

Alberta |

Vacation pay can be paid any time, but it must be by the next regularly scheduled payday before an employee’s next annual vacation begins.

If an employer has not fully paid the vacation pay before this, the employee may request that the employer pay the amount owing at least one day before the vacation starts, and the employer must comply.

Vacation pay can also be paid on each pay day. |

|

British Columbia |

Vacation pay must be paid at least seven days before an employee begins vacation.

Employers can also pay vacation pay on vacation pay on an employee’s scheduled paydays. This can only be done if the employer and employee agree to it in writing or it is part of a collective agreement. |

|

Manitoba |

Employers can decide when to pay vacation pay, but this must be by the employee’s last workday before the vacation begins.

Employers are also allowed to pay vacation pay with regular pay. |

|

New Brunswick |

Vacation pay must be paid at least one day before the employee starts their vacation. |

|

Newfoundland and Labrador |

Vacation pay can be paid at least one day before an employee starts their vacation.

Vacation pay can also be paid on each pay period if the employer informs the employee and shows the vacation pay amount in their payroll. |

|

Northwest Territories |

Vacation pay must be paid at least one day before the employee starts their vacation. |

|

Nova Scotia |

Employers must pay vacation pay at least one day before an employee starts their vacation.

Employers may also do so with regular pay, but they must clearly inform their employees and keep records showing that they did.

Employers must also identify vacation pay on an employee’s pay slip and maintain payroll records that show that vacation pay has been paid. |

|

Nunavut |

Vacation pay must be paid at least one day before an employee starts taking vacation. |

|

Ontario |

Vacation pay must be paid in a lump sum before the vacation begins. Vacation pay may also be given on or before the payday that relates to the pay period when the employee takes the vacation. But this can only be done if the employer pays the employee by direct deposit or if the employee’s vacation is less than one week.

Employers and employees may also agree in writing that the employer will pay vacation pay each period as it accrues. This is if the employer clearly shows the amount of vacation pay separately from other amounts on the employee’s pay statement.

Employers and employees may also agree on any date when vacation pay will be paid if the agreement is in writing. |

|

Prince Edward Island |

Vacation pay must be paid at least one day before the employee starts their vacation. |

|

Québec |

Vacation pay must be paid in a lump sum before the employee begins the vacation. An exception applies for farm workers who are hired by the day. In this instance, employers may pay the vacation pay with each pay.

If a collective agreement or decree allows for it, employers may also pay vacation pay in another manner. |

|

Saskatchewan |

Vacation pay must be paid on the employee’s normal payday or, if the employee requests it, before the vacation starts.

Vacation pay may also be paid on each payday if the employee agrees. |

|

Yukon |

Vacation pay must be paid at least one day before the employee starts their vacation. |

If you’re searching for industry professionals who can assist with your payroll needs, our Best in HR Special Reports page is the place to go. The companies featured in our special reports have been nominated by their peers and vetted by our panel of experts as trusted and respected industry leaders. By partnering with these market leaders, you can be sure that your HR and payroll processes remain compliant with industry regulations and standards.

Did you find this guide on vacation pay on vacation pay helpful? Let us know in the comments.