Provinces and territories have different rules on employee wages. But how does each define wages exactly? Find out in this guide

Updated May 30, 2024

The term “wages” appears widely throughout Canadian employment standards. For example, all federal and provincial employment standards require employers to calculate vacation pay based on the wages earned by employees.

But what is the definition of wages exactly? What do wages consist of and how are they paid? How are wages different from salaries? Canadian HR Reporter answers these questions and more in this article.

If you’re an employer or an HR professional wanting to gain a deeper understanding of how this compensation structure works, this guide can help. Read on and find out everything you need to know about definition of wages in Canada.

What is the definition of wages in Canada?

Statistics Canada (StatCan) provides a broad and technical definition of wages and salaries:

“Wages and salaries comprise the gross pay before tax that is paid to employees in cash or in kind, for work performed under the general direction of an employer. Fundamental to this definition is an inherent employer-employee relationship or contract of service, where the employer defines:

- the time and place of work

- the nature of the work

- the compensation provided for work done

“Also implied in this employer-employee relationship is a certain level of direct or indirect control, where the employer is ultimately responsible for the hiring of employees and the termination of their employment.”

In layman’s terms, salaries and wages are defined as monetary compensation that employees receive for the work they have done for a certain period. While often used interchangeably, there’s actually a huge difference between these payment structures.

Wages are based on an hourly rate and the number of hours employees take to finish any assigned work. Salaries are fixed amounts that employers agree to pay their workers in a given period, usually a year.

Find out more about the difference between wages and salaries in this guide.

What is included in wages?

According to StatCan, wages typically include a combination of:

- base pay

- commissions

- performance bonuses

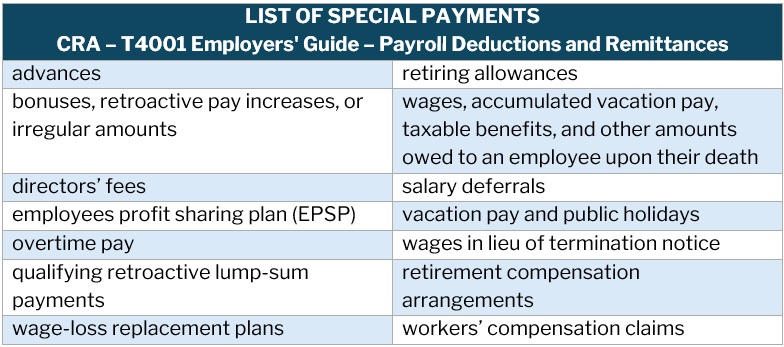

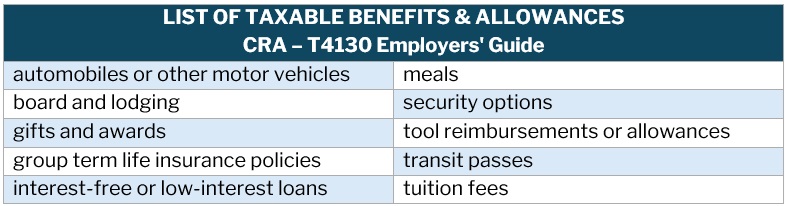

- special payments such as retroactive pay increases, overtime pay, and directors' fees

- taxable allowances and benefits such as automobile allowances, board and lodging, and gifts

The tables below list what the Canada Revenue Agency (CRA) considers special payments and taxable benefits.

Definition of wages – list of special payments (Canada Revenue Agency - T4001)

Definition of wages – list of taxable benefits & allowances (Canada Revenue Agency - T4130)

All the items listed above comprise an employee’s gross wage. This is the total amount they earn before applicable payroll taxes and deductions are taken out.

What are the deductions from employee wages in Canada?

Employers are required to deduct certain items from employee wages. Part of the deductions go to public funding. Some are used to provide workers with assistance at certain points of their lives like unemployment, parental leave, and retirement.

Wage deductions come in several forms, including:

- federally or provincially required deductions such as income taxes, CPP/QPP, and EI premiums

- those authorized by a court order, including child support payments

- those authorized by a collective agreement, including union dues

- deductions designed to collect overpaid wages

Employees can also authorize their employers to make other deductions, including those intended as:

- charitable donations

- life insurance and long-term disability premiums

- medical and dental premiums

- pension plan or RRSP contributions

- savings plan contributions

Employment and Social Development Canada (ESDC) notes that for an authorization to be valid, it must meet certain criteria:

- the authorization must be in writing

- it must set out the specific amount, purpose, and frequency of the deductions

These requirements are placed to ensure that employees understand what they’re signing and how this impacts their wages.

ESDC reminds employers that they cannot force employees to sign an authorization. They also cannot make wage deductions for property damage without the written consent of their workers.

If you believe that your worker is liable for property damage, your alternative is to go to civil court. The court will then decide on the matter.

Federally or provincially required deductions

Employers are required to make three types of deductions from employee wages based on federal and provincial laws:

1. Income tax

Employers deduct income taxes from employee wages and remit them to the government. These deductions are used to fund public services.

Income tax deductions are based on how much income the employee earns. Because federal and provincial governments implement their own tax rates, where the worker lives also affects how much taxes are deducted.

2. Canada Pension Plan

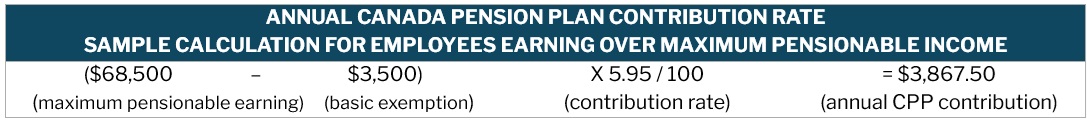

The Canada Pension Plan (CPP) provides employees a taxable pension to replace a portion of their income during retirement. Québec runs its own pension plan, the Québec Pension Plan (QPP), which the province’s employers and workers contribute to.

The maximum pensionable earning under the CPP for 2024 is $68,500, with a basic exemption amount of $3,500. Employee and employer contribution rates are 5.95 percent.

Here’s a sample calculation of the annual CPP contribution of an employee earning more than the maximum pensionable earning.

Definition of wages – Canada Pension Plan sample calculation

Definition of wages – Canada Pension Plan sample calculation

The same formula applies to employees earning below the maximum pensionable income. All you need to do is replace the maximum pensionable value with the employee’s annual income.

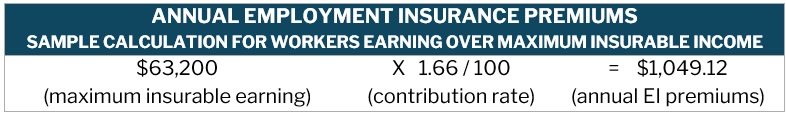

3. Employment insurance premiums

Employment insurance (EI) makes sure that the employees’ earnings are protected. It provides them with temporary financial assistance if they are unable to work.

The maximum insurable earnings for 2024 is $63,200. EI contribution rate is 1.66 percent.

For those earning over the maximum insurable, here’s a sample calculation.

Definition of wages – Employment insurance premium sample calculation

Learn more about how payroll deductions are calculated in this guide.

How are wages paid?

Employers must establish a regular pay period, including the pay day, for their employees. Wages can be paid weekly, biweekly, or monthly. During each pay period, employers are required to pay all the wages earned, no later than the agreed upon pay day.

For vacation pay, special rules apply. Payment of commissions and bonuses, meanwhile, depends on the employment contract.

Wages are often paid in three ways:

- cash

- cheque

- direct deposit into the employee's bank account

If the wages are paid by cash or cheque, they must be given at the workplace or another location agreed upon by the employee. If the payment is through direct deposit, the account must be under the employee’s name. It must also be accessible to the employee only, unless they have authorized others to access it.

What is the minimum wage in Canada?

The federal minimum wage in Canada is set at $17.30 per hour. This provides the baseline for which workers should be paid. To keep pace with inflation, the rate is adjusted automatically every 1st of April each year.

In 2022, for example, the minimum wage rate was $15.55 per hour. This rose to $16.65 per hour in 2023. On April 1, 2024, the rate was adjusted to its current level as the Consumer Price Index (CPI) increased an average of 3.9 percent last year.

Provinces and territories implement their own employment and labour laws and standards, which include minimum wage rates. They also have their own process for revising the minimum wage.

The federal minimum wage above applies to employees in federally regulated industries, regardless of where they work. These include:

- air transportation (airlines and airports)

- banks

- federal public service and parliament

- First Nations band councils and Indigenous self-governments

- postal services and other Crown corporations

- port services

- road transportation services and railways

- television and radio broadcasting

- telecommunications

The provincial minimum wage applies to other types of workers, although there are exceptions. We will discuss these special minimum wage rates later.

Provincial and territorial minimum wage rates in Canada

Here’s the list of the general minimum wage rates by province and territory in 2024. You can also click on the links to check the rules regarding minimum wage in your jurisdiction.

|

Jurisdiction |

Wage rate |

Effective date |

Notes |

|

$15.00 |

June 26, 2019 |

|

|

|

$16.75 |

June 1, 2023 |

Scheduled to increase to $17.40 on June 1, 2024 |

|

|

$15.30 |

October 1, 2023 |

Scheduled to increase to $15.80 on Oct. 1, 2024 |

|

|

$15.30 |

April 1, 2024 |

|

|

|

$15.60 |

April 1, 2024 |

|

|

|

$16.05 |

September 1, 2023 |

|

|

|

$15.20 |

April 1, 2024 |

|

|

|

$16.00 |

April 1, 2020 |

|

|

|

$16.55 |

October 1, 2023 |

|

|

|

$15.40 |

April 1, 2024 |

Scheduled to increase to $16 on October 1, 2024 |

|

|

$15.25 |

May 1, 2023 |

|

|

|

$14.00 |

October 1, 2023 |

Scheduled to increase to $15 on October 1, 2024 |

|

|

$17.59 |

April 1, 2024 |

|

Special minimum wage rates: a breakdown by province & territory

Some provinces and territories impose special minimum wage rates for workers of certain ages and occupations. Here’s the list sorted by province.

Alberta

|

Occupation |

Wage rate |

|

Students under 18 working up to 28 hours per week |

$13 per hour |

|

Salespersons |

$598 per week |

|

Live-in domestic workers |

$2,848 per month |

British Columbia

|

Occupation |

Wage rate |

|

Farm workers who hand harvest |

strawberries: $0.466 per pound Brussels sprouts: $0.221 per pound daffodils: $0.186 per bunch |

|

Liquor servers |

$17 per hour |

|

Live-in home support workers |

$124.73 per day |

|

Live-in camp leaders |

$133.69 per day |

|

Resident caretakers of building with 9 to 60 units |

$1,002.53 per month |

|

Resident caretakers of building with 61+ units |

$3,414.85 per month |

New Brunswick

|

Occupation |

Wage rate |

|

Crown construction workers, e.g. roads |

Varies |

|

Non-commissioned workers whose hours can’t be verified |

$649 per week |

|

Residential camp counsellor and program staff |

$649 per week |

Nova Scotia

|

Occupation |

Wage rate |

|

Early childhood educators |

$23.59 to $35.57 |

|

Logging and forestry workers |

$15 per hour |

Ontario

|

Occupation |

Wage rate |

|

Students under 18 working up to 28 hours per week |

$15.60 per hour |

|

Liquor servers |

$16.55 per hour |

|

Homeworkers (do paid work in own home) |

$18.20 per hour |

|

Hunting, fishing, and wilderness guides |

$82.85 to $165.75 per day, depending on the number of hours |

Québec

|

Occupation |

Wage rate |

|

Farm workers who hand harvest |

strawberries: $1.21 per kg raspberries: $4.53 per kg |

|

Employees who usually receive gratuities |

$12.20 per hour |

Yukon

|

Occupation |

Wage rate |

|

Employees of Yukon government-tendered construction projects |

Varies per fair wage schedule |

How is wage calculated?

Wages and salaries are calculated differently because of the variations in compensation structures.

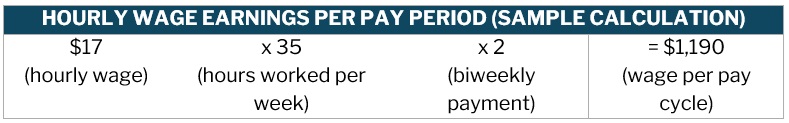

Hourly wages calculation

To calculate a wage earner’s pay during a pay cycle, the hourly wage is multiplied by the number of hours they worked. Here’s a sample calculation for an hourly wage earner who worked 35 hours a week at a rate of $17 per hour and paid biweekly.

Definition of wages – hourly wage earnings sample calculation

The wage earner gets a paycheque of $1,190 before deductions during the pay cycle.

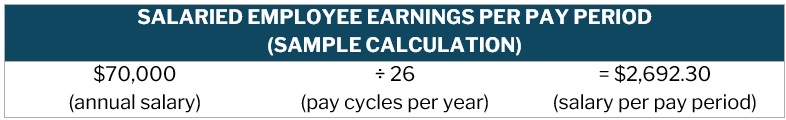

Salary calculation

For salaried employees, the fixed annual amount is divided by the number of pay cycles for the year. Here’s a sample calculation for a salaried worker who earns $70,000 yearly and is paid on a biweekly basis.

Definition of wages – salaried employee earnings sample calculation

The salaried employee receives a paycheque of $2,692.30 before deductions biweekly.

Regardless of how they are paid, the amount an employee earns is impacted by several factors, including:

- their role within the company

- responsibilities and expectations for the role

- their experience level and educational background

- their tenure with the company

- where the business is located and the cost of living in the area

- industry average with similar positions

- industry demand for jobs for available and qualified workforce

Wages can also be easily influenced by market conditions and the rules on wage rates can change. Keep abreast of the latest developments by visiting our Payroll News Section. Be sure to bookmark this page to access breaking news and the latest industry updates.

Do you agree with the government’s definition of wages? Let us know in the comments.