Varying statutory holidays and labour laws make calculating holiday pay a bit tricky. This guide shows you how to calculate stat holiday pay across Canada

Updated 17 May 2024

Most employees in Canada are entitled to paid statutory holidays off work. It’s the employers’ responsibility to ensure that workers get the appropriate compensation. Failure to do so can lead to serious legal consequences.

While statutory holidays exist on the federal level, each province and territory also implement their own regional holidays. These differences can make compliance a bit tricky.

If you’re an employer or an HR professional trying to work out how much you owe employees in holiday compensation, this guide can help you sort things out. Here, the Canadian HR Reporter explains how to calculate stat holiday pay and who is eligible. We will also list which dates are considered holidays in each jurisdiction.

How is stat holiday pay calculated?

Stat holiday pay is calculated as the daily rate based on the employees' average earnings in a certain period leading up to the holiday. For most employees, stat holiday compensation is equal to 1/20 of their regular earnings from the four weeks preceding the holiday. The calculation excludes overtime pay.

It’s often easier to calculate stat holiday pay for fixed salaried employees. This is because the law requires employers to split the amount between the worker’s regular salary and the statutory holiday pay.

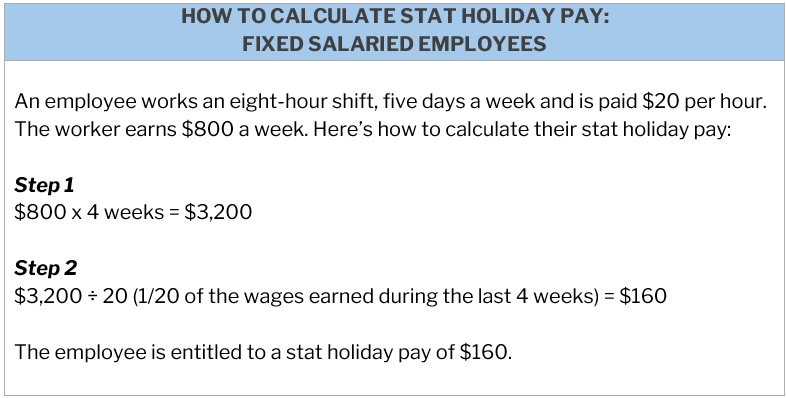

How to calculate stat holiday pay – fixed salaried employees

Here’s a sample calculation for an employee with a fixed rate who works a regular schedule.

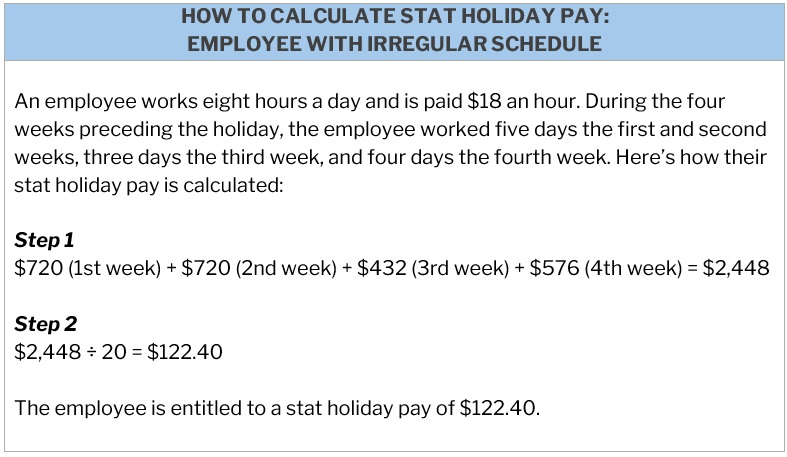

In some cases, however, a daily average needs to be calculated based on the earnings for a specific period. This includes part-time employees whose pay is adjusted based on the number of hours they work.

How to calculate stat holiday pay – employee with irregular schedule

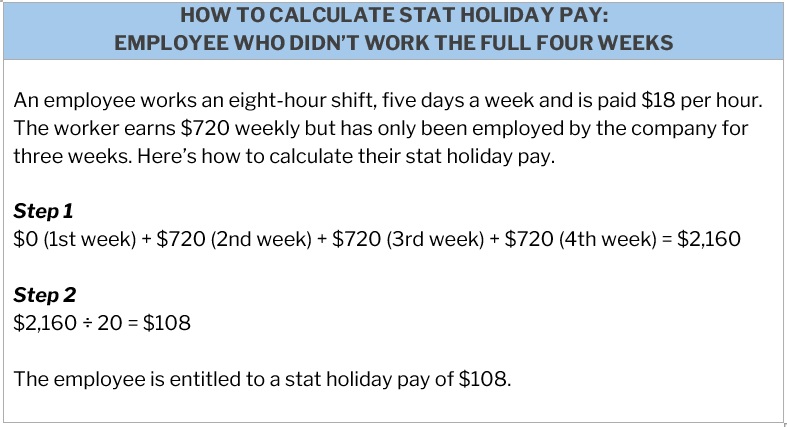

How to calculate stat holiday pay – employee without full four weeks

How to calculate stat holiday pay – employees required to work on a general holiday

Because the Canada Labour Code doesn’t ban work on statutory holidays, some employees may be required to work on the dates that fall on public holidays. For these workers, their salaries may need to be adjusted to account for the hours they logged in during those days.

Employees who are required to work during a stat holiday are generally entitled to:

- wage not less than 1.5 times their regular rate of pay for the time they worked

- general holiday pay for that day

These workers will also no longer receive an additional leave entitlement for that holiday.

Going back to our first example above, we already calculated the stat holiday pay to be $160. Let’s say the employee was required to work a full eight-hour shift during a general holiday. Apart from the holiday pay, they are entitled to:

Step 1

$20 (regular rate) x 8 (hours worked) x 1.5 = $240 (wage for the time worked during the holiday)

Step 2

$240 + $160 = $400 (total holiday pay)

In total, the employee who was required to work during a statutory holiday is entitled to receive $400 for a full day’s work.

How to calculate stat holiday pay – continuous operations

The Ministry of Employment and Social Development of Canada (ESDC) describes a continuous operation to be one of the following:

- a business that operates in a seven-day period without interruption

- telephone, radio, television, telegraph, and other communication or broadcasting operations

- scheduled or non-scheduled transportation or shipping operations

- operations or services carried out even during Sundays or general holidays

Depending on the arrangement with employers, workers in continuous operations are entitled to any of the following:

- at least 1.5 times their regular rate of pay for the actual hours worked in addition to the stat holiday pay

- pay for the actual hours worked at their regular rate of wages and additional leave entitlement to their annual vacation

- stat holiday pay for the first day they don’t work after the general holiday, if permitted by their collective agreement

How to calculate stat holiday pay – employees paid by commissions

Commission-based employees are entitled to a statutory holiday pay of at least 1/60 of their earnings for the 12-week period immediately before the general holiday. This is given that they have completed at least 12 weeks of continuous employment.

For those who haven’t reached this milestone, they can receive compensation of at least 1/20 of their earnings in the four-week period leading up to the holiday.

How to calculate stat holiday pay – longshoring sector

Workers in the longshoring sector or multi-employer units are entitled to holiday pay equal to their basic rate multiplied by at least 1/20 of the total hours they worked. This excludes overtime hours and covers the four-week period before the holiday.

For those who work for an employers’ association and another employer who isn’t a member, a different calculation applies. In this case, the non-member employer pays 3.5% of the worker’s basic rate times the number of hours they worked during the pay period. This is in lieu of a stat holiday pay.

If the longshoring employee is required to work during a public holiday, they are also entitled to be paid at least 1.5 times the regular rate for the time they worked on that day.

Employees who don’t report to work on a public holiday

Employees who are scheduled to work on a general holiday but don’t show up lose their stat holiday pay for that day. This is regardless of the type of employment.

What are statutory holidays?

In Canada, employers are legally required to observe statutory holidays based on federal, provincial, and territorial labour laws. Also called public or general holidays, stats, or stat holidays, these days are considered as employees’ paid time off and not part of their annual leave.

Employees of federally regulated businesses are entitled to 10 paid stat holidays every year:

- New Year’s Day – January 1

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- National Day for Truth and Reconciliation – September 30

- Remembrance Day – November 11

- Christmas Day – December 25

- Boxing Day – December 26

Not all statutory holidays are observed throughout the country:

- Boxing Day isn’t considered a public holiday in Alberta and British Columbia.

- Many retail businesses in Alberta, however, treat it as such.

- Victoria Day and Thanksgiving aren’t part of the official statutory holidays in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

- In Québec, Easter Monday is observed instead of Good Friday.

Some general holidays are called by different names in certain provinces. In Québec, Victoria is known as National Patriots’ Day (Journée nationale des patriotes). In Newfoundland and Labrador, Canada Day is referred to as Memorial Day.

Provinces and territories also observe their own holidays, which they add to their list of stat holidays. These differences are often where the confusion on how to calculate stat holiday pay starts.

To ensure compliance, businesses should consult their jurisdiction’s Ministry of Labour. We will list these agencies, along with the links to their official websites, later in this article.

Who is eligible for statutory holiday pay?

All full-time, part-time, and casual employees of federally regulated businesses are entitled to paid statutory holidays. Those working on general holidays are entitled to be paid one and a half times their regular hourly rates on top of the holiday pay.

If the stat holiday falls on an employee’s scheduled day off, then a paid day off may be added to their annual vacation. There are exceptions, however, for certain holidays that fall on a Saturday, Sunday, or other non-working day. These holidays are:

- New Year’s Day

- Canada Day

- Remembrance Day

- Christmas Day

- Boxing Day

If these public holidays fall on a weekend or non-working days, workers are entitled to paid time off on the working day immediately preceding or following the holiday.

How does stat holiday pay work in different provinces and territories?

Each province and territory observe different sets of general holidays and has their own rules when it comes to stat holiday pay. Here’s a breakdown by jurisdiction.

Alberta

List of statutory holidays

- New Year’s Day – January 1

- Family Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Alberta employees are entitled to stat holiday pay equal to their average daily wage if the holiday falls on a regular day of work. If it doesn’t, then the workers aren’t entitled to any holiday pay.

If the employees are required to work on a public holiday on a regular day of work, they receive:

- pay equal to at least their average daily wage

- stat holiday pay of 1.5 times the regular rate for the hours they worked

If the holiday falls on a non-regular day of work, employees only get the general holiday pay.

British Columbia

List of statutory holidays

- New Year’s Day – January 1

- Family Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- British Columbia Day – 1st Monday in August

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- National Day for Truth and Reconciliation – September 30

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

BC employees receive an average day’s pay for a statutory holiday that falls on a regular or scheduled workday. For those who are required to work, they are entitled to get 1.5 times their regular wages for the work hours they complete. If their work exceeds 12 hours, they receive twice their basic rates.

Manitoba

List of statutory holidays

- New Year’s Day – January 1

- Louis Riel Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Orange Shirt Day – September 30

- Thanksgiving Day – 2nd Monday in October

- Christmas Day – December 25

How stat holiday pay works

Employees in Manitoba who have fixed work schedules receive a general holiday pay equal to their regular daily wage. For those whose work hours vary, stat holiday pay is calculated at 5% of their gross wages in the four-week period before the holiday. The calculation doesn’t include overtime hours.

Employees who work on a statutory holiday are entitled to 1.5 times their regular rate of pay for the hours worked. This is in addition to their general holiday pay.

New Brunswick

List of statutory holidays

- New Year’s Day – January 1

- Family Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- New Brunswick Day – 1st Monday in August

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

- Boxing Day – December 26

How stat holiday pay works

New Brunswick workers get a regular day’s pay for a general holiday. Employees who work are paid an amount 1.5 times their regular wages for their total hours. This is on top of the stat holiday pay they’re entitled to.

Newfoundland and Labrador

List of statutory holidays

- New Year’s Day – January 1

- Good Friday – Friday before Easter Sunday

- Memorial Day – July 1

- Labour Day – 1st Monday in September

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Workers in Newfoundland and Labrador are entitled to a regular day’s pay for a statutory holiday if:

- they have been with their employer for at least 30 calendar days

- they have worked their scheduled shifts prior to and after the public holiday

Employees who work on a statutory holiday may get any of the following as compensation:

- wages at twice their regular rates for the hours worked

- additional day off within 30 days of the holiday

- additional paid vacation day

Northwest Territories

List of statutory holidays

- New Year’s Day – January 1

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- National Indigenous Peoples Day – June 21

- Canada Day – July 1

- 1st Monday in August

- Labour Day – 1st Monday in September

- National Day for Truth and Reconciliation – September 30

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Eligible employees in the Northwest Territories who don’t work on a statutory holiday receive an amount equal to their average day’s pay. Those who work get another day off with pay or an average day’s pay on top of overtime pay for the hours logged in during the holiday.

Nova Scotia

List of statutory holidays

- New Year’s Day – January 1

- Nova Scotia Heritage Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Christmas Day – December 25

How stat holiday pay works

Employees are entitled to a regular day’s pay for a statutory holiday in Nova Scotia. For those who work, they also receive holiday pay equal to 1.5 times their basic wage for the hours they cover.

Nunavut

List of statutory holidays

- New Year’s Day – January 1

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Nunavut Day – July 9

- 1st Monday in August

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Nunavut employees are entitled to a regular day’s pay for a statutory holiday. If they work, they receive their regular daily wage and either stat holiday pay of one and a half times their regular pay or an additional paid time off.

Ontario

List of statutory holidays

- New Year’s Day – January 1

- Family Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- National Day for Truth and Reconciliation – September 30

- Christmas Day – December 25

- Boxing Day – December 26

How stat holiday pay works

Ontario employees are eligible for statutory holiday pay equal to 1/20 of their earnings from the four-week period before the holiday. This is if they follow the "first and last" rule. This means they have worked their scheduled shifts before and after the public holiday.

In addition to the holiday pay, employees who work are entitled to either:

- a premium pay, which is equal to one and a half times their regular wage times the number of hours they worked

- their regular rate for the hours worked plus a substitute paid time off, also known as a day in lieu

The employer decides which of these options apply.

Prince Edward Island

List of statutory holidays

- New Year’s Day – January 1

- Islander Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Canada Day – July 1

- Labour Day – 1st Monday in September

- National Day for Truth and Reconciliation – September 30

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Workers are entitled to general holiday pay equal to their regular day’s pay in Prince Edward Island. If they are required to work, they get a premium rate of 1.5 times the standard rate. If work exceeds their scheduled work hours, employees receive double their regular wage.

Employees who work on Christmas Day are paid the holiday premium rate of double time for the total hours they worked.

Québec

List of statutory holidays

- New Year’s Day – January 1

- Good Friday or Easter Monday, at the employer’s option

- National Holiday – June 24

- Canada Day – July 1

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- Christmas Day – December 25

How stat holiday pay works

Workers in Québec are entitled to statutory holiday pay equal to 1/20 of their earnings from the four-week period before the holiday. An employee who is required to work on a public holiday receives their wages for the day plus either:

- a statutory holiday pay

- a paid vacation time off, which must be taken within three weeks before or after the statutory holiday, except for the National Holiday

The employer decides which of these options apply.

Saskatchewan

List of statutory holidays

- New Year’s Day – January 1

- Family Day – 3rd Monday in February

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- Canada Day – July 1

- Saskatchewan Day – 1st Monday in August

- Labour Day – 1st Monday in September

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Workers in Saskatchewan are entitled to stat holiday pay of 5% of their regular wages in the 28 days before a public holiday. The calculation includes any vacation and holiday pay they receive during the period, but excludes overtime pay.

Employees working on a holiday earn 1.5 times their regular hourly rate for all hours worked on top of the general holiday pay.

Yukon

List of statutory holidays

- New Year’s Day – January 1

- Good Friday – Friday before Easter Sunday

- Victoria Day – Monday preceding May 25

- National Indigenous Peoples Day – June 21

- Canada Day – July 1

- Discovery Day – 3rd Monday in August

- Labour Day – 1st Monday in September

- National Day for Truth and Reconciliation – September 30

- Thanksgiving Day – 2nd Monday in October

- Remembrance Day – November 11

- Christmas Day – December 25

How stat holiday pay works

Yukon employees who work regular hours are entitled to a day’s pay for a statutory holiday. Those who work receive their regular daily wage and either stat holiday pay of one and a half times their hourly rate or an additional paid vacation time. In lieu of annual vacation entitlement, employers can also give workers a day off at a time convenient to both parties.

You can find more details about how to calculate stat holiday pay in your province or territory through the Ministry of Labour’s website. We compiled the links below for easy access.

|

Province/Territory |

Department |

|

Alberta Labour Relations Board |

|

|

BC Ministry of Labour |

|

|

Manitoba Labour Board |

|

|

NB Labour and Employment Board |

|

|

NL Labour Relations Board |

|

|

NWT Labour Development and Standards |

|

|

Nova Scotia Labour Board |

|

|

Nunavut Labour Standards Compliance Office |

|

|

Ontario Ministry of Labour |

|

|

PEI Labour Relations Board |

|

|

CNESST |

|

|

SK Ministry of Labour Relations and Workplace Safety |

|

|

Yukon Workers' Safety and Compensation Board |

Knowing how to calculate stat holiday pay is an important responsibility of every employer in Canada. To ensure you comply with the law, bookmark this guide and refer back to it as needed. Staying informed not only ensures legal compliance but also fosters employee trust and morale.

Get the latest updates on statutory holiday pay in your jurisdiction on our Payroll News Section. Don’t forget to bookmark this page for easy access to breaking news and the latest industry updates.

Did you find this guide on how to calculate stat holiday pay in Canada helpful? Let us know in the comments.