CRA's automobile benefits online calculator provides an accurate estimate of an employee's benefit amount. Learn how to use it in this guide

Updated January 21, 2025

The automobile benefits calculator (ABOC) helps employers determine an employee’s estimated automobile benefit amount for withholding purposes. The tool was developed by the Canada Revenue Agency (CRA), with the latest version launched in 2023.

In this article, the Canadian HR Reporter gives you a step-by-step walkthrough on how to use the ABOC. We will also discuss how automobile benefits work and how these are calculated.

Employers and payroll specialists who may not be familiar with the tool may find this guide useful. Here’s how the CRA’s automobile benefits online calculator can make your job easier.

How does the automobile benefits online calculator work?

The CRA introduced the ABOC in 2010 to assist HR and payroll professionals in calculating how much of the benefits should be prorated to the employee’s pay period. You can access the latest version of the automobile benefits online calculator here.

The tool helps employers determine the following:

- the taxable benefit amount to be reported on T4 or T4A slip for the past year

- the benefit amount to be included in the worker’s current income when doing payroll

The ABOC factors in the rules in the CRA’s T4130, also called the Employers’ Guide for Taxable Benefits and Allowances, when calculating the benefit amount. While you can find other automobile benefit calculators online, CRA’s version provides more accurate calculations because of this feature.

How to use the Automobile Benefits Online Calculator: a step-by-step guide

Using the CRA’s automobile benefits online calculator is straightforward.

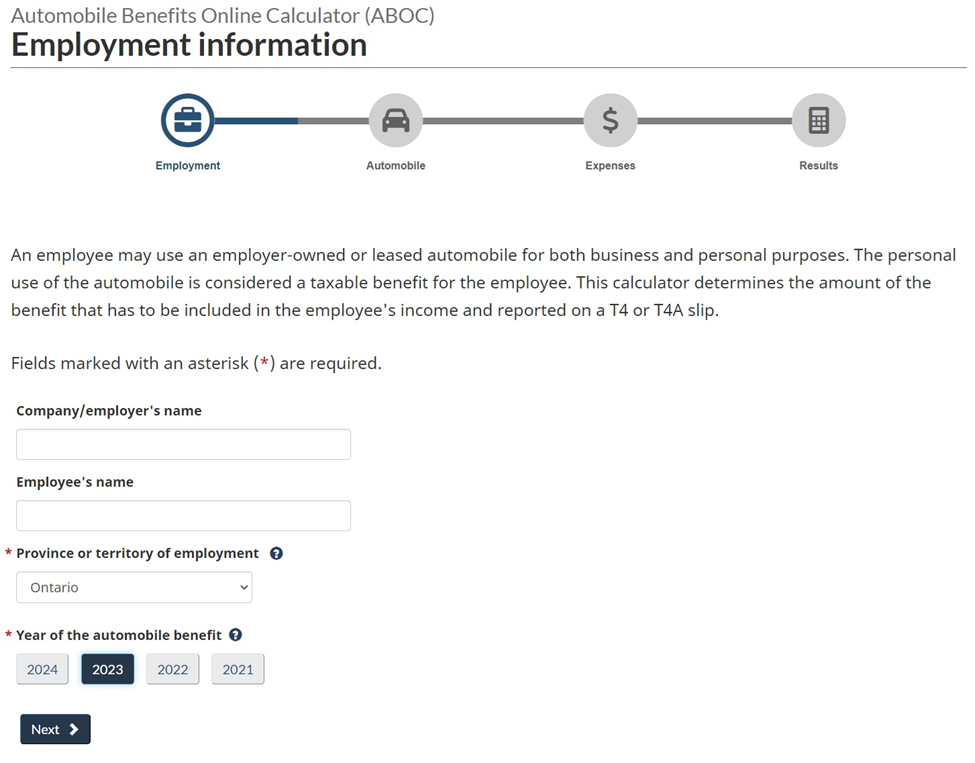

Step 1: Employment information

You will first be directed to the employment information page. Here, you will be required to provide:

The province or territory of employment

This is where the employee physically reports for work or where their salary or wages are paid from. This helps determine the proper tax deductions.

The year of the automobile benefit

This is the year you’re calculating the automobile benefits for. It also determines the rates for calculation as new rates are released two weeks into the year.

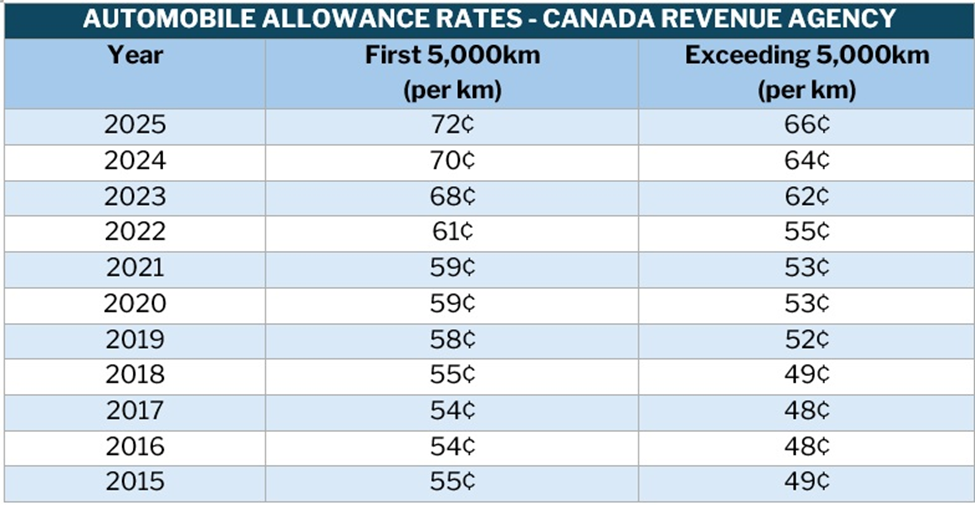

Here are Canada’s automobile benefit rates from 2015 to the current year.

In the Northwest Territories, Nunavut, and Yukon, employees get an additional 4¢ per kilometre driven.

You can also disclose the employer’s and employee’s names, but these aren’t required. Once done, click “Next.”

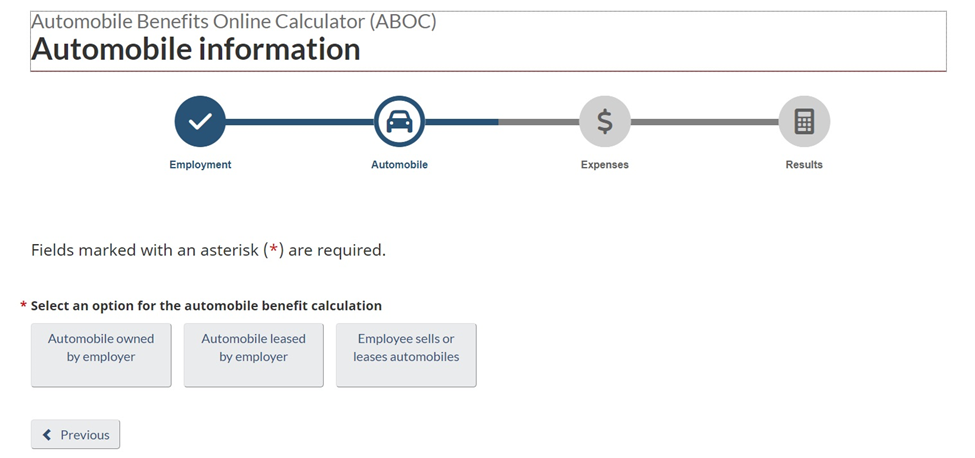

Step 2: Automobile information

In this page, you will be asked to select the type of automobile your employee drives. You have three options:

- automobile owned by employer

- automobile leased by employer

- employee sells or leases automobile

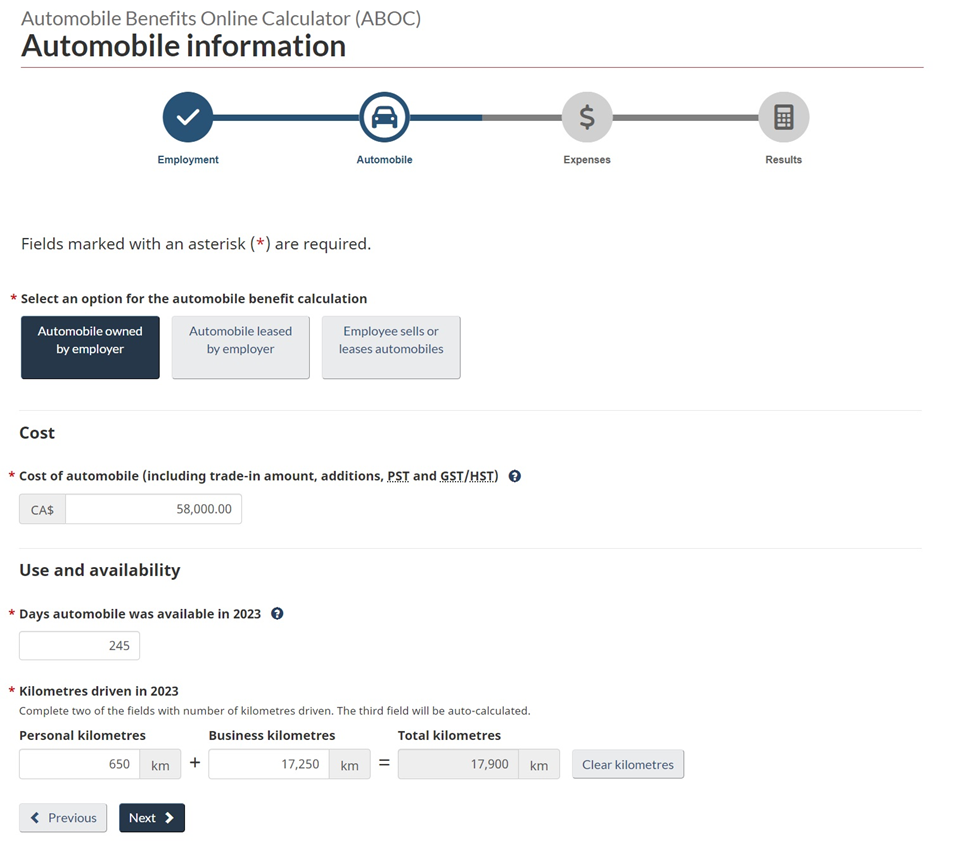

Once you have chosen the appropriate automobile type, you will be asked to provide information about the vehicle’s cost, availability to the employee, and distance driven.

The cost must include the following:

- the automobile’s worth when purchased, including add-ons and accessories

- the GST/HST and PST, excluding any reduction for a trade-in

- the cost of add-ons and accessories, including GST/HST and PST, after the automobile was bought

If the automobile was purchased from a non-arm's length person, the cost is often equal to the fair market value when the vehicle was bought. This includes add-ons and GST/HST and PST.

For availability, this includes any part of the day, weekends, and holidays that the employee has access to or control over the vehicle.

For kilometres driven, you will be asked to provide the total distance travelled for business and personal reasons. Personal driving includes the commute to and from work. The sum is auto-calculated. Once done, you can click “Next.”

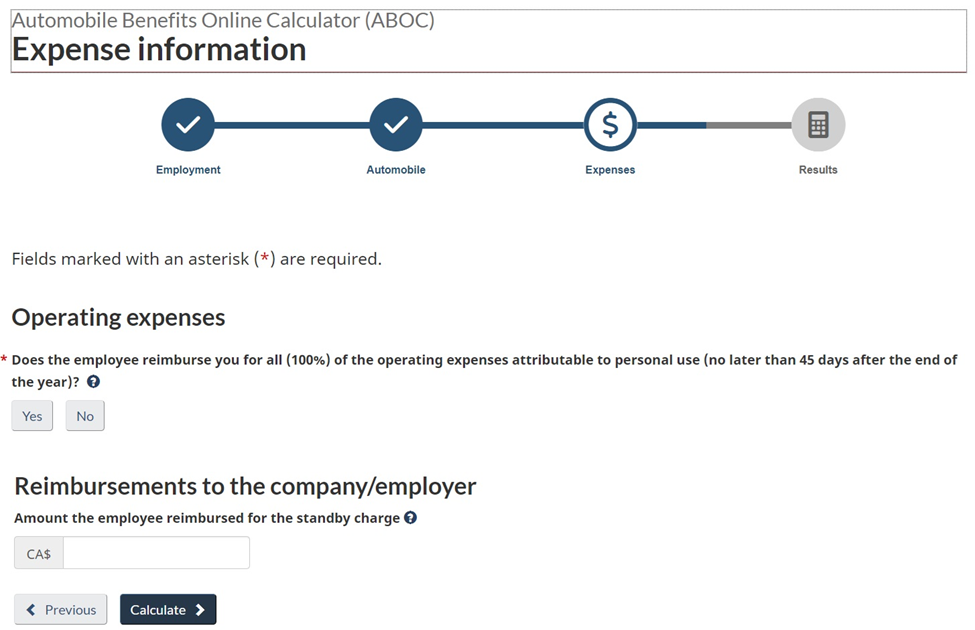

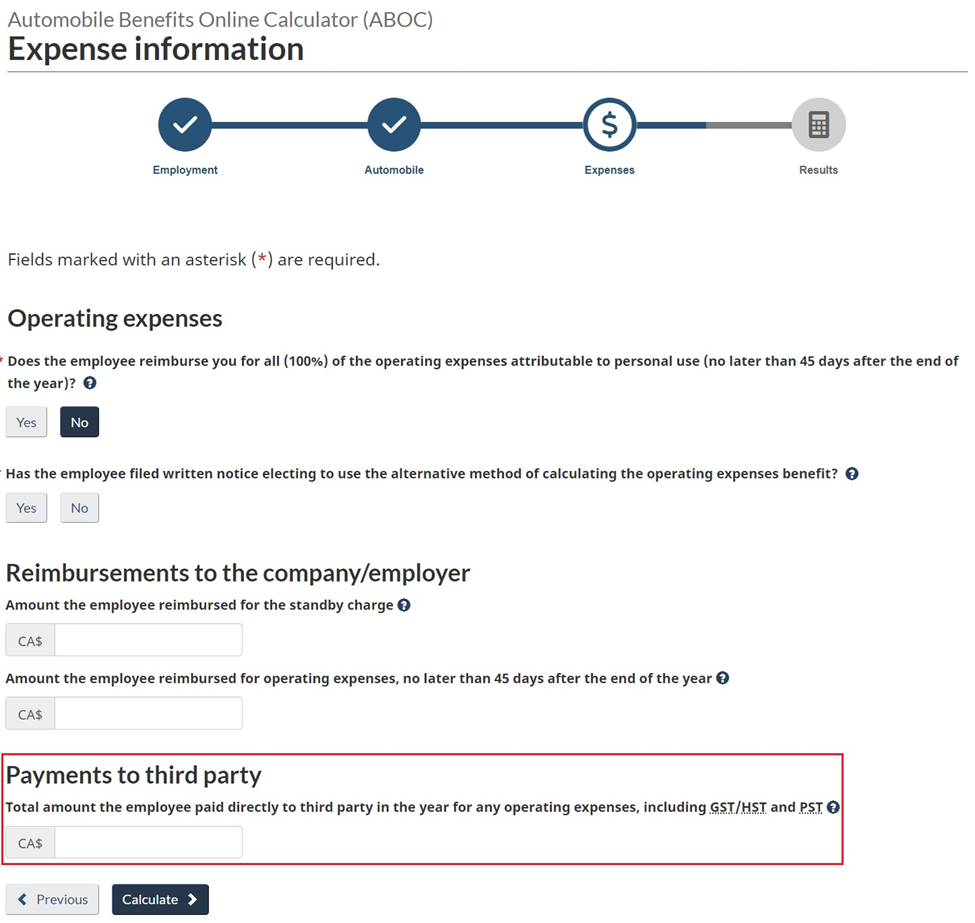

Step 3: Expenses information

In the expense information page, you will need to provide two types of information:

1. Operating expenses

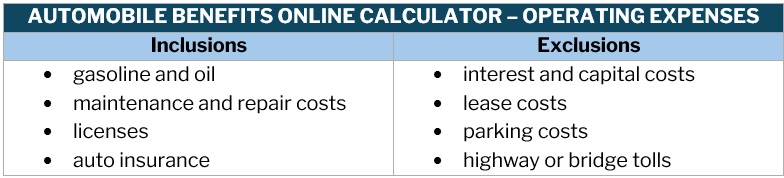

Here’s a list of what are considered operating costs and what aren’t.

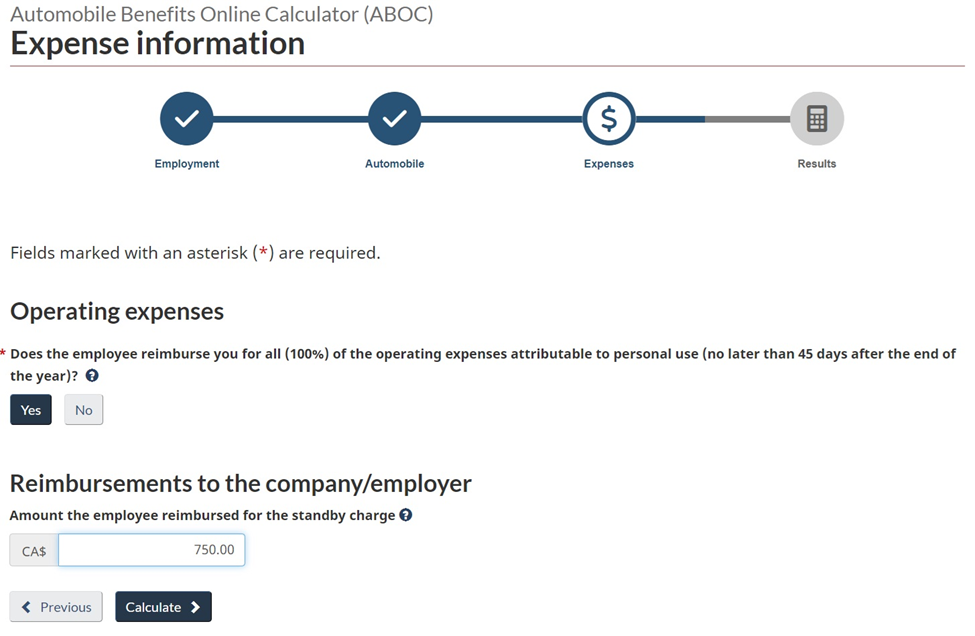

No operating cost benefits are calculated if your employee reimburses all operating expenses attributable to personal use not later than 45 days after the end of the year.

If they don’t, then there are two ways to calculate operating cost:

Fixed rate calculation

In this method, the number of personal-use kilometres is multiplied by a fixed rate. For 2025, the fixed rate is 34¢ per kilometre.

Optional calculation

Here, the operating expense benefit is calculated at half of the standby charge. This may result in a higher benefit amount compared to fixed rate calculation.

If operating expenses must be calculated, you will also be asked to provide the total amount paid to third parties. This includes GST/HST and PST.

2. Reimbursements to the company/employer

This is the total amount the employee has reimbursed to the employer for the standby charge. The standby charge is the benefits an employee receives when their employer lets them use the company automobile for personal reasons. Any reimbursements made by the employee – excluding those for operating expenses – will decrease the standby charge in their income.

Once done, click “Calculate.” This will lead you to the results page.

Step 4: View the results.

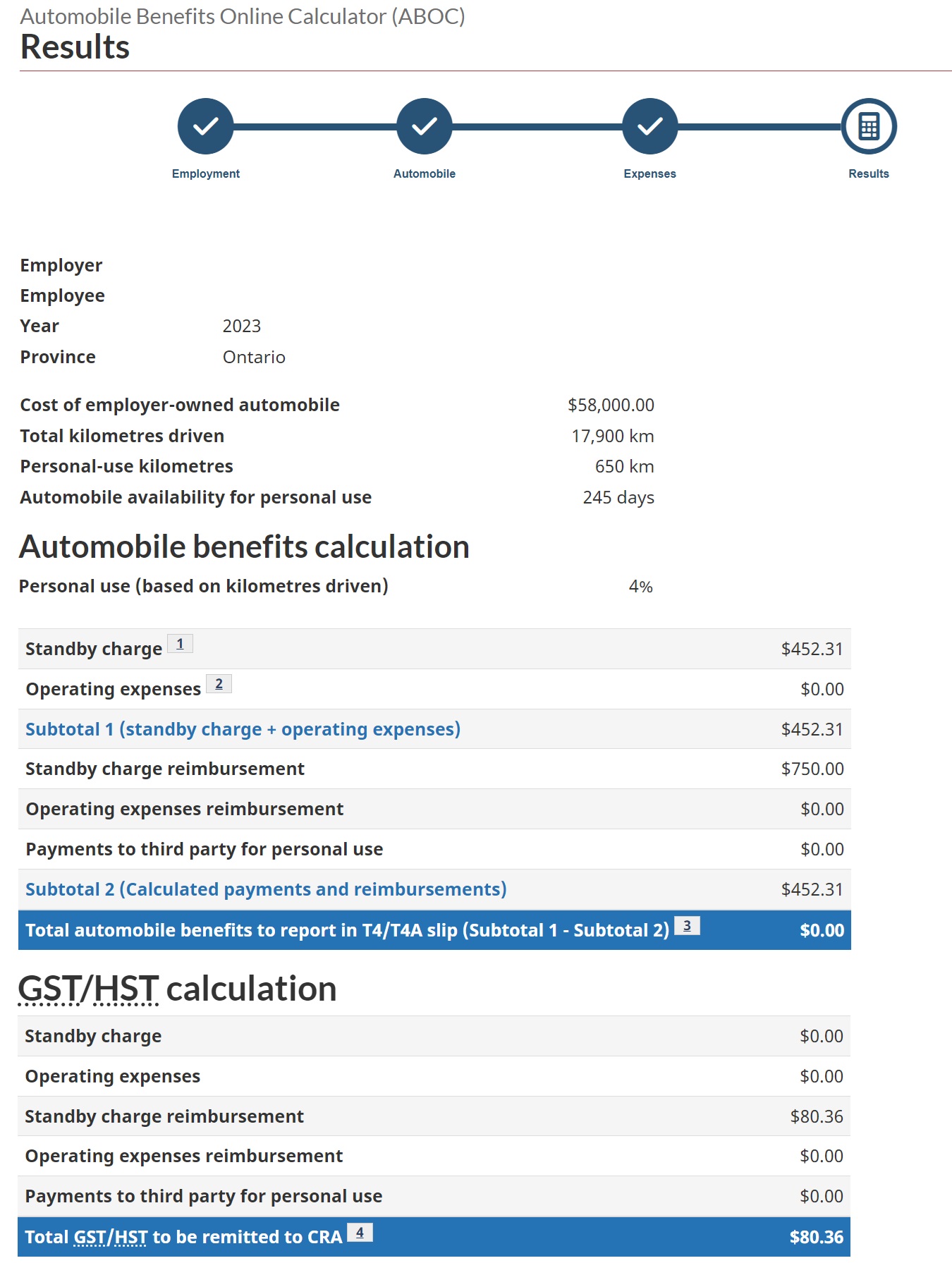

Here are the results for our hypothetical employee.

The results page also contains footnotes to explain how the automobile benefits online calculator arrived at a particular figure.

What vehicles are eligible for automobile benefits?

The CRA defines an automobile as a type of motor vehicle designed to carry individuals on highways and streets. It must also have a seating capacity of not more than the driver and eight passengers.

Given this definition, these aren’t considered as automobiles:

- ambulances

- clearly marked police or fire emergency response vehicles

- clearly marked emergency medical response vehicles

- motor vehicles used primarily – meaning more than 50% of the distance driven – as taxi or bus used in transportation business, or hearse in a funeral business

- motor vehicles used in sales, rental, or leasing businesses

- motor vehicles used in a funeral business to transport passengers

Vans, pickup trucks, and similar types of vehicles aren’t considered an automobile if:

- they can seat no more than the driver and two passengers

- at least 50% of the mileage in the year they were acquired or leased is for the transport of goods or equipment

- at least 90% of the mileage is for transport of goods, equipment, or passengers

Additionally, pickup trucks bought or leased in the tax year aren’t classified as an automobile if:

- at least 50% of the mileage is for transport of goods, equipment, or passengers “in the course of earning or producing income”

- they are used at a remote work location or at a special work site at least 30 kilometres away from any community with a population of at least 40,000

Defining what an automobile is is important for tax purposes because the benefits are calculated differently compared to other types of motor vehicles. Want to test your knowledge of taxable benefits rules, try this.

How are automobile benefits of employees calculated?

If you want to know how the automobile benefits online calculator comes up with the figures, there are certain terms that you need to understand:

1. Personal use or personal driving

The CRA defines personal driving as any form of driving not related to one’s work, including:

- travel between home and regular place of employment

- driving for personal activities

- vacation trips

As an employer, you may allow an employee to use a vehicle you own or lease for personal reasons. An employee may also use their personal vehicle for work-related duties and receive an allowance from you. In these scenarios, your employees become eligible for a taxable automobile benefit that’s considered a part of their income.

2. Operating cost

Operating costs consist of employer-paid expenses needed to keep an automobile running. These include fuel, maintenance and repair costs, licenses, and auto insurance. Car policies can be expensive but there are ways to access affordable coverage. Here are some tips on how you can get cheap car insurance in Canada.

Costs that the employee incurs while using the vehicle for personal driving, however, aren’t considered operating expenses. These include parking costs and toll fees. Interest costs and capital cost allowance are also not classified as such and not eligible for taxable benefits.

To calculate the taxable benefit, you multiply a fixed rate set by the CRA with the number of personal driving kilometres. Here’s a list of the fixed rates from 2016 to 2025.

- 2016: 26¢

- 2017: 25¢

- 2018: 26¢

- 2019 & 2020: 28¢

- 2021: 27¢

- 2022: 29¢

- 2023 & 2024: 33¢

- 2025: 34¢

Here’s the formula for calculating operating costs:

You can also use an optional method, which involves the standby charge, if certain conditions are met.

3. Standby charge

The standby charge is designed to estimate the automobile’s depreciation attributable to personal driving. The calculation is based on several factors:

- the purchase or lease cost of the vehicle

- the number of days the automobile is made available to the employee

- the extent of personal use

An automobile is considered available to an employee if they have access to or control over the vehicle. This is regardless of whether the vehicle is in use, or it sits unused in a garage, driveway, or parking spot.

Here’s the standard formula for calculating standby charge:

4. Reduced standby charge

As the name suggests, a reduced standby charge is designed to decrease the tax implications for employees who use an employer-provided automobile as little as possible for personal driving.

Before 2003, a reduced standby charge applied only if these two criteria are met:

- personal driving that didn’t exceed 12,000 kilometres throughout the year

- at least 90% of the distance driven was for business purposes

These criteria were changed in 2003 to:

- personal driving that doesn’t exceed 1,667 kilometres per month or 20,004 kilometres throughout the year

- at least 50% of the distance driven was for business purposes

These changes allow many employees whose personal use of an employer-provided vehicle is restricted to have their automobile benefits calculated using the reduced standby charge.

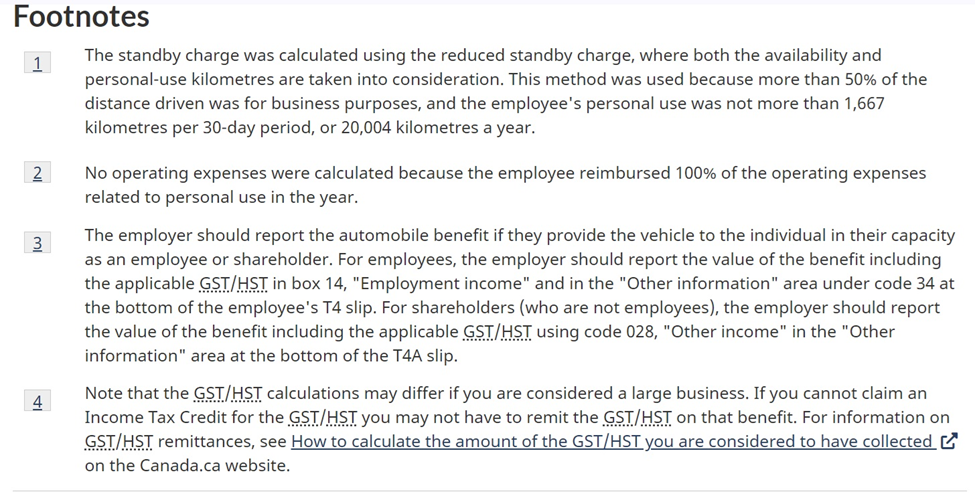

Here’s the formula for calculating reduced standby charge:

Apart from the automobile benefits online calculator, you can use the Form RC18 to calculate the total amount.

The formula for calculating automobile benefits is:

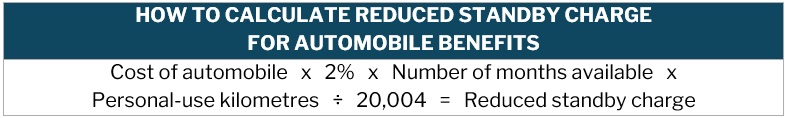

Here’s a sample calculation for the automobile benefits of an employee who drives an employee-provided vehicle for 30,000 kilometres for business and 12,000 kilometres for personal use. The automobile benefit being calculated is for 2023.

Because the employee’s personal driving doesn’t exceed 20,004 kilometres a year and the vehicle is used for business more than 50% of the time, the reduced standby charge applies.

Automobile benefits online calculator – automobile benefits with reduced standby charge sample calculation

The CRA updates the automobile allowance rates and operating expenses fixed rates every year to ensure reasonable and accurate benefits calculations. You can visit our Payroll News Section regularly if you want to keep abreast of these changes. Be sure to bookmark this page to access breaking news and the latest industry developments.

Have you experienced using the CRA’s automobile benefits online calculator? Did you find it helpful? Share your thoughts in the comments section below.