A look at key proposed amendments

In 2017, Ontario’s Liberal government introduced and passed Bill 148, referred to as the Fair Workplaces, Better Jobs Act. Controversial on many fronts, Bill 148 made sweeping changes to Ontario’s employment and labour landscape.

In October 2018, Ontario’s Conservative government under Premier Doug Ford introduced the Making Ontario Open For Business Act, 2018 (Bill 47) which, when passed, will in large part return Ontario’s employment and labour laws to their pre-Bill 148 status, with some exceptions.

If passed in their present form, the amendments to the Employment Standards Act, 2000 (ESA) will take effect on the later of Jan. 1, 2019 and the date of royal assent. The amendments to the Labour Relations Act, 1995 (LRA) will come into force on the date of royal assent. In this article, we focus on the ESA amendments:

Minimum wage

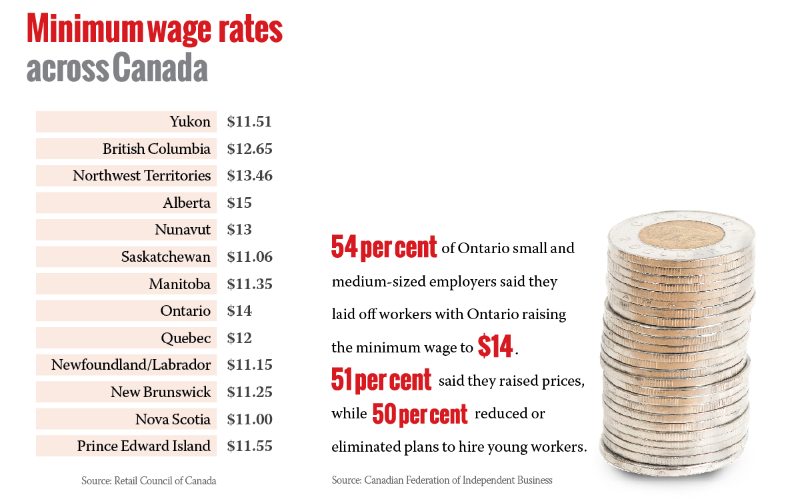

•Minimum wage will remain at $14 come Jan. 1, 2019.

•Recent increases to the minimum wage under Bill 148 will not be rolled back.

•Increases to minimum wage will be paused for 33 months with annual increases tied to inflation starting in 2020.

Bill 148’s abrupt increase to the general minimum wage was troubling for employers given the direct impact this has on labour costs and competitiveness.

Early in its mandate, the Ford government signaled the minimum wage would not increase to $15 in Jan. 1, 2019, as contemplated by Bill 148. However, there had been speculation as to whether the $15 increase would be pushed to 2020 or beyond. Cost-of-living increases commencing in 2020 give employers a period to adjust to the significant increase introduced in January 2018.

Scheduling

Bill 47 repeals all of the scheduling provisions that were to come into force on Jan. 1, 2019. Specifically:

•The right to request a change to schedule or work location after an employee has been employed for at least three months.

•A minimum of three hours’ pay for being on-call if the employee is available to work but is not called in to work, or works fewer than three hours.

•The right to refuse a request or demand to work or be on-call on a day an employee is not scheduled to work or to be on-call with fewer than 96 hours’ notice.

•The requirement to pay three hours’ pay in the event of cancellation of a scheduled shift or an on-call shift within 48 hours before the shift was to begin.

•All of the record-keeping provisions introduced to address these new scheduling provisions.

The repeal of these provisions allows employers to maintain flexibility in scheduling practices. For a business with unpredictable workforce requirements, such as in the retail, hospitality and homecare industries, the Bill 148 amendments were not realistic.

Three-hour rule

Bill 47 introduces an amendment to the “three-hour rule” similar to that which was included in Bill 148. Where an employee is regularly scheduled to work more than three hours a day but works fewer than three hours, even if available to work longer, the employee will be entitled to the greater of (i) the amount earned for the time worked plus the worker’s regular rate for the remainder of the three hours, and (ii) the employee’s regular rate for three hours of work.

Personal Emergency Leave

One of more significant proposed amendments in Bill 47 repeals the controversial changes to the ESA Personal Emergency Leave (PEL) provisions introduced by Bill 148. Specifically, Bill 47 removes PEL entirely, replacing it with three separate unpaid leaves designed to address the specific situations to which PEL applied prior to Bill 148. A worker with at least two consecutive weeks of employment will have the following entitlements:

•Sick Leave: Up to three days per year for the employee’s illness, injury or medical emergency.

•Family Responsibility Leave: Up to three days per year for the illness, injury, medical emergency or urgent matter related to a prescribed family member.

•Bereavement Leave: Up to two days per year because of the death of a prescribed family member.

For each of these leaves, an employer may request evidence reasonable in the circumstances to verify entitlement to the leave (including a medical note from a qualified health practitioner, reversing Bill 148’s prohibition on requiring medical documentation to support a PEL leave). Bill 47 also expressly recognizes that if an employee takes a paid or unpaid leave under an employment contract in circumstances that would otherwise entitle the employee to one of these ESA leaves, the employee is deemed to have taken leave under the ESA as well.

Under the Bill 148 amendments, as of Jan. 1, 2018, every employee in the province was entitled to two additional paid PEL days off per year and a further eight unpaid PEL days, for which no corroborating medical documentation could be requested. This was one of the most controversial amendments made by Bill 148.

Many employers have their own policies that provide for a variety of leaves, both paid and unpaid. Bill 47 addresses how these contractual benefits will intersect with an employee’s entitlement to sick leave, family responsibility leave and bereavement leave, providing clarity to employers on an issue not addressed in Bill 148.

Other leaves

The leave provisions for cases of domestic and sexual violence affecting an employee or an employee’s child introduced by Bill 148 remain unchanged. This includes the entitlement to up to five paid days of leave under this section of the ESA. Bill 47 also does not propose any amendments to the expanded and enhanced parental leave, pregnancy leave, critical illness leave, family medical leave, child death leave, or crime-related child disappearance leave provisions currently in force.

Related employer

The amendments to the related employer sections of the ESA introduced by Bill 148 remain unchanged. Prior to Bill 148, two employers that were engaged in associated or related businesses could be declared one employer only if the intent or effect of their arrangement defeated the purpose of the ESA. Bill 148 removed the “intent or effect” condition.

The related employer provision may be used to impose ESA obligations, such as severance pay, on two or more entities engaged in associated or related activities or businesses, when those obligations would not exist if the entities remained separate employers.

Vacation

Bill 47 makes no change to the vacation entitlements introduced by Bill 148. After five years of employment, an employee remains entitled to three weeks of vacation time and six per cent vacation pay.

Public holiday pay

Under Bill 47, public holiday pay is calculated based on the formula used pre-Bill 148. A worker’s public holiday pay is equal to the total amount of regular wages earned and vacation pay payable to the employee in the four weeks before the work week in which the public holiday occurred, divided by 20.

Initially, the Bill 148 public holiday amendment was significant, particularly for an employer with casual employees. Under Bill 148, an employee who worked a single eight-hour day in the pay period preceding the public holiday, and nothing more, was entitled to the same amount of public holiday pay as an employee who worked five days per week at eight hours a day. Thankfully, the previous government corrected this and, as of July 1, 2018, temporarily reverted back to the pre-Bill 148 formula. The current proposed amendment will permanently maintain the pre-Bill 148 formula.

Employee misclassification

Bill 47 amends the employee misclassification section introduced by Bill 148. If there is a dispute as to whether an individual has been misclassified as an independent contractor, the employer will no longer bear the burden of proving the individual is not an employee. The individual who claims to be an employee will have the onus to prove his employee status.

Equal pay for equal work

Other than the requirement for equal pay on the basis of sex (which was included in the ESA prior to Bill 148), an employer will no longer be required to provide equal pay based on employment status (part-time, casual, and temporary). Bill 47 also repeals the requirement a temporary help agency pay an agency employee at the same rate of pay as an employee of the client performing substantially similar work.

The Bill 148 amendments failed to recognize that many employers pay a part-time, casual or temporary employee at a different rate because she has less experience performing the work than a full-time counterpart or has less of a connection to the workplace. The Bill 148 amendments significantly increased the cost to employers of hiring or keeping on part-time, casual and temporary employees. This ultimately hurt employees, particularly those who work in casual or temporary employment for the flexibility it provides.

Penalties for contravention

Administrative penalties for contraventions of the ESA, which had been increased to $350/$700/$1,500 under Bill 148, are expected to return to $250/$500/$1,000.

Lisa Bolton and Gerald Griffiths are lawyers at Sherrard Kuzz in Toronto, an employment and labour law firm representing management. They can be reached at (416) 603-0700 (main), (416) 420-0738 (24-hour) or by visiting www.sherrardkuzz.com.