Nearly three-quarters of gig workers also employed full-time or part-time: report

More than one in five (22%) Canadians are participating in gig work of various kinds across the country. That equates to about 7.3 million adults finding work outside of regular employment.

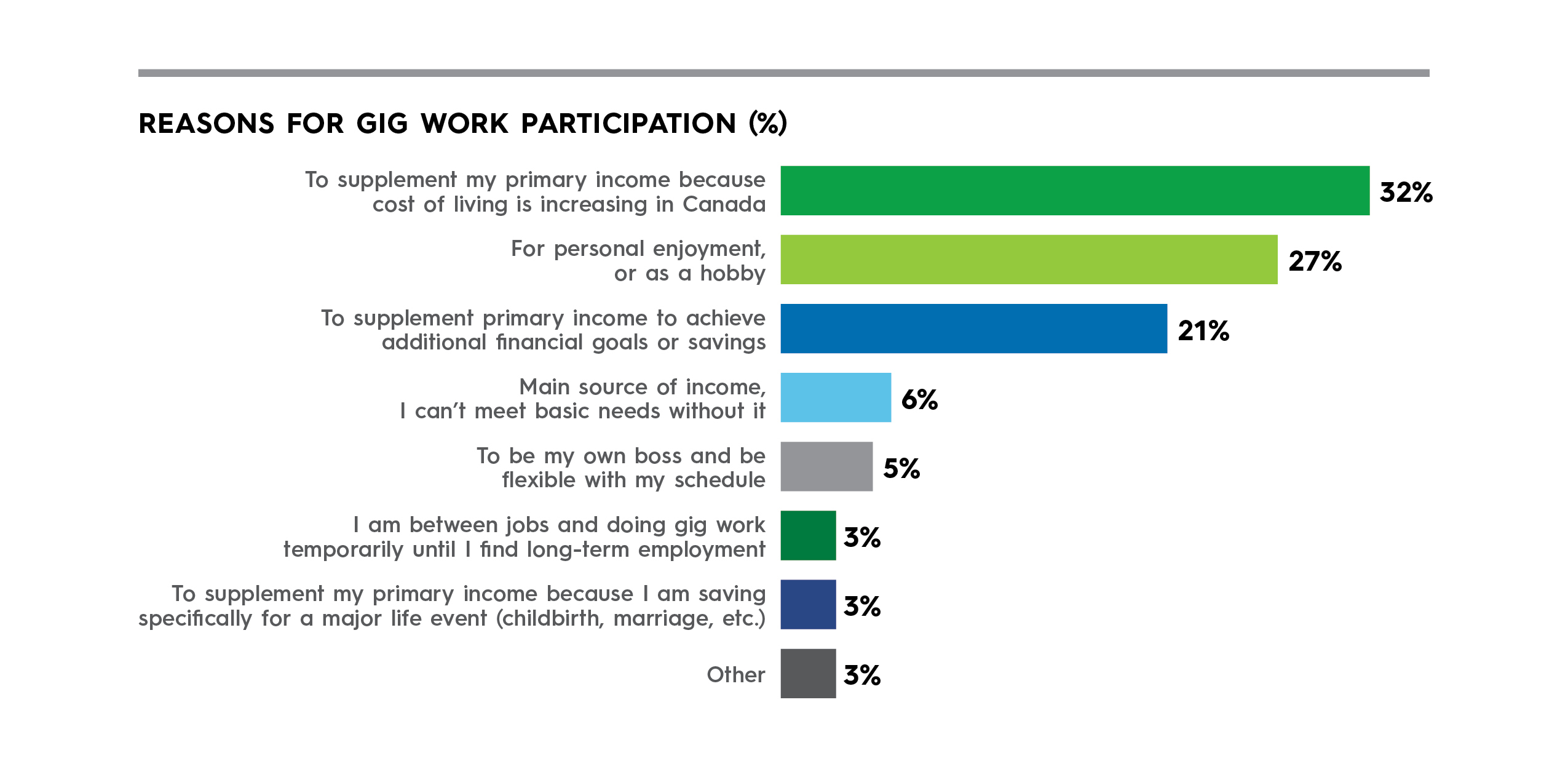

And they are doing it for a variety of reasons, reports Securian Canada, with more than half (57%) — or roughly four million people — relying on this type of work to supplement their primary income.

Nearly three-quarters (73%) of all gig workers are either employed full-time or part-time outside of their gig work.

The most common reason Canadians are engaging in gig work is the increased cost of living, cited by nearly one-third (31%) of gig workers.

Recently, on Sept. 5, 2024, the Ontario government proclaimed the Digital Platform Workers’ Rights Act, 2022. The Act focuses on “digital platform work”, and establishes various rights for workers who perform such work, even if the worker is not technically an employee at law.

This means that the rights pursuant to this new Act will also apply to contractors, which is a big shift from the rights provided under the Employment Standards Act, 2000 (ESA).

Lack of insurance in gig economy

While workers in the gig economy are making money, they are being left financially susceptible, according to two surveys by Securian Canada: one on 1,515 Canadians and another on 505 Canadian gig workers, in June.

Specifically, half of those who rely on gig work as their only source of income have no insurance. When asked if they have certain types of insurance, such as life, health and dental, critical illness or disability, nearly one-fifth (18%) of gig workers said they do not have insurance.

“Gig workers are often financially vulnerable, raising concerns about the long-term financial security of this emerging segment of the workforce,” says Nigel Branker, chief executive officer, Securian Canada.

“The economic climate in Canada continues to introduce new challenges and gig workers are finding themselves in a particularly vulnerable stat. As the nature of gig work and the income it generates is often unpredictable, insurance is an important tool and can truly be a financial lifeline in times of need.”

Previously, an expert at Deloitte told Canadian HR Reporter that few large employers are using the gig economy, but they should seriously consider getting involved with it.

Should employers provide benefits for gig workers?

Employers “should bet big on gig” workers, says Danielle Guzman, global head of social media at Mercer.

With the number of Canadians entering the gig economy, “freelance and gig workers represent a novel challenge for HR and people leaders alike, who are now charged with finding a way to integrate these new workers into the existing org structure and day-to-day business,” she says.

“Organizations can make the gig economy work for them by focusing on the same principles that make them an outstanding employer of traditional talent.”

She notes that gig workers are attracted to benefits, along with stability, flexibility, companies who value their services and a collaborative work culture.